The Architecture of Salesforce Financial Services Cloud

Salesforce Financial Services Cloud (FSC) has become the world’s leading industry-specific CRM platform, holding 20.7% of the global CRM market share and serving over 150,000 businesses worldwide. Designed for banking, insurance, wealth management, and credit unions, FSC empowers organizations to achieve a 188% ROI, 15–45% higher cross-sell rates, and up to 30% cost reductions.

This guide provides a deep dive into FSC’s architecture, explaining how its core platform evolution, data model design, integration framework, AI capabilities, and security layers deliver enterprise-grade performance.

1. Evolution of the FSC Architecture

From Managed Package to Core Platform

Originally launched in 2016 as a managed package, FSC delivered a specialized financial services data model but came with limitations—manual installation, reliance on push upgrades, and slower access to platform innovations.

Salesforce addressed these constraints by transitioning to a core platform integration strategy. This architectural evolution:

- Eliminates managed package installations—reducing setup time and complexity.

- Speeds up deployment of industry-specific applications.

- Reduces maintenance overhead by aligning updates with Salesforce’s regular release cycle.

- Improves flexibility by embedding key features—such as Financial Goals, Groups & Households, and Rollups—directly into the Salesforce platform.

2. Platform Infrastructure & Scalability

FSC is built on Salesforce’s multi-tenant cloud architecture, delivering scalability, security, and high performance for organizations of any size.

Key Architectural Pillars

- Metadata-Driven Architecture – Enables configuration without heavy coding, keeping upgrades seamless.

- Lightning Platform Integration – Modern UI and mobile optimization, including offline functionality for relationship managers.

- Multi-Cloud Support – Seamless integration with Service Cloud, Marketing Cloud, Commerce Cloud, and Data Cloud to create a unified customer experience.

3. Data Model Architecture

The Financial Services Industry Data Model is FSC’s heart, designed specifically to reflect the complexity of financial relationships and products.

Object Categories

- Standard Salesforce Objects – Accounts, Contacts, Opportunities, Cases.

- FSC Standard Objects – Financial Account, Insurance Policy, Mortgage, Action Plan, Consent, Interaction.

- FSC Packaged Objects – Industry-specific models for insurance, mortgages, and financial deals.

Key Components

- Financial Account Object – Segments accounts by product type (checking, savings, loans, investments, insurance). Recent enhancements store balances as child records for improved reporting.

- Actionable Relationship Center (ARC) – Visualizes relationships between clients, accounts, and advisors.

- Household & Group Management – Guided UIs for creating and managing households with rollups across accounts and products.

- Interaction Tracking & Timelines – Complete audit trails for all client communications.

Also Read – Salesforce Financial Services Cloud For Insurance Service

4. Integration Architecture

FSC’s API-first integration model enables real-time data exchange across financial systems, supporting:

- Real-Time/Synchronous – RESTful APIs for transactional processes (e.g., account updates).

- Near Real-Time/Asynchronous – Event-driven pub/sub messaging for scalability.

- Batch Processing – For large-scale reporting and compliance.

Industry-Standard Integration Models

- BIAN Canonical Model – Ensures interoperability across banking systems.

- MuleSoft Direct Integrations – Prebuilt templates accelerate connections to core banking and payment systems.

- Core Banking Accelerators – Provide ready-to-use APIs for rapid deployment.

5. AI & Automation Architecture

FSC tightly integrates with Salesforce Einstein AI to deliver predictive insights and automation:

- Einstein Analytics for Financial Services – Customizable dashboards with AI-augmented intelligence.

- Einstein Prediction Builder – Tailored prediction models for churn, conversion, and risk scoring.

- Einstein Next Best Action – AI-driven recommendations for optimal engagement.

With the launch of Agentforce, FSC now supports:

- Conversational AI Agents – Automating client queries and task handling.

- Agentforce Testing Center – AI-generated test scenarios to validate accuracy and compliance.

- Einstein Trust Layer – Field-based masking for sensitive data.

6. Security & Compliance Architecture

Financial institutions operate under some of the strictest data protection and regulatory standards in the world. FSC’s architecture embeds multi-layered security to meet these demands.

Multi-Layered Security Framework

- Einstein Trust Layer – Uses metadata to detect and mask sensitive fields (e.g., account numbers, PII) before data is exposed to AI processes.

- Role-Based Access Control (RBAC) – Sophisticated permissions with conditional record formatting.

- Audit Logging – Every change and system interaction is logged for compliance reporting.

Regulatory Compliance Features

- TLS 1.3 – Ensures secure outbound HTTPS connections.

- Advanced Event Monitoring – Real-time tracking of user activity to detect anomalies.

- Automated Compliance Workflows – Action Plans and Flow automation enforce required disclosures, approvals, and documentation.

Also Read – Salesforce Financial Services Cloud for Mortgage Lending

7. Implementation Patterns & Cost Architecture

Deployment Strategies

- Phased Rollouts – Begin with core CRM capabilities, then layer on AI, automation, and advanced integrations.

- Data Migration Planning – Costs range from $5K–$15K (small orgs) to $200K–$800K (global enterprises).

- Integration Complexity Management – API and middleware work can increase project costs by 40–180%.

Cost Breakdown (2025 Benchmarks)

Cost Component | Small Business | Global Enterprise |

Licensing | $300–$475/user/month | Same pricing, scaled by volume |

Implementation Services | $15K–$50K | $500K–$2M+ |

Total Project Investment | $65K–$180K | $2.7M–$14.3M+ |

8. Performance & Scalability

Real-Time Capabilities

- Instant Data Refresh – Eliminates lag from batch updates, improving advisor response times.

- Cross-Object Field History Tracking – Enables audit teams to track related record changes automatically.

Scalability Enhancements

- Removed Financial Account Triggers – Boosts query and integration performance.

- Horizontal Scaling via Multi-Tenant Cloud – Automatically expands capacity as needed.

- Multi-Region Deployment Support – Meets localization and data residency requirements.

9. Future-Ready Architecture

FSC continues to evolve in line with emerging financial technology trends:

- Generative AI via Agentforce – Supports advanced NLP-powered client interactions.

- Data Cloud Integration – Unifies structured and unstructured data for deeper insights.

- Industry Cloud Expansion – Enables cross-sector growth into healthcare, manufacturing, and more.

- API Enhancements – Dynamic sorting, improved consumption forecasting, and faster list view rendering.

- Developer Tools – Agentforce SDK for Python-based programmatic interactions.

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Conclusion

Salesforce Financial Services Cloud’s modern architecture—evolved from a managed package into a fully integrated core platform—delivers the scalability, flexibility, and intelligence financial institutions need to thrive in 2025 and beyond.

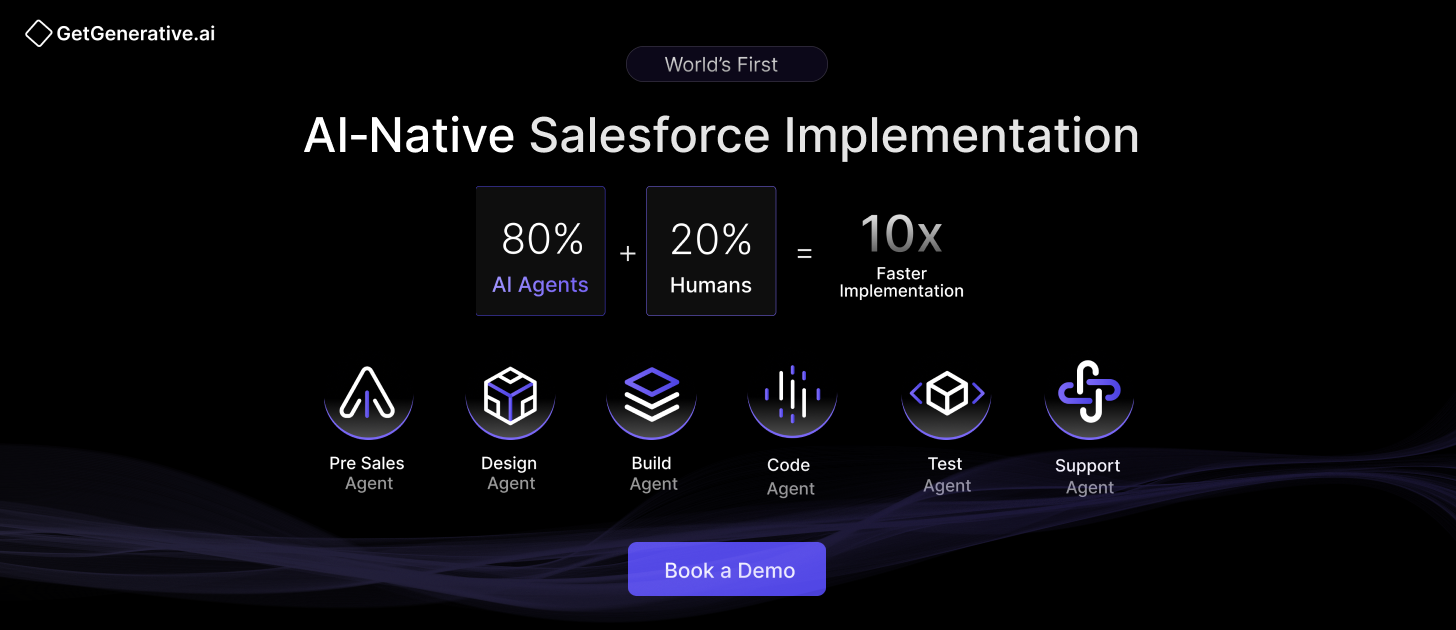

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services