Compliant Data Sharing in Salesforce Financial Services Cloud

Salesforce Financial Services Cloud (FSC) has emerged as a strategic solution, providing purpose-built compliance capabilities that balance secure collaboration with regulatory adherence.

For senior executives, the stakes are high: over 75% of European compliance leaders report a 35% increase in compliance workloads, and nearly half of financial firms plan to increase their compliance technology budgets in 2025.

This blog explores how FSC’s compliant data sharing transforms data governance, ensures regulatory adherence, and improves operational efficiency.

The Escalating Compliance Imperative in Financial Services

Regulatory Complexity at Critical Mass

The financial services industry operates within a constantly expanding web of regulations. The SEC plans to introduce 25 new rules in 2024, while frameworks like the EU’s Digital Operational Resilience Act (DORA) and PCI DSS 4.0 demand more sophisticated technology responses. Institutions must manage compliance across GDPR, CCPA, SOX, GLBA, and now emerging AI governance frameworks.

Jurisdictional differences further complicate compliance. In the UK, 36% of firms faced penalties in 2023, while regulations such as the FCA’s Consumer Duty forced 63% of firms to overhaul customer service models. This patchwork of global and local rules creates a compliance minefield that requires both robust systems and flexible adaptation.

The Real Cost of Compliance Failures

The financial impact of non-compliance is staggering. GDPR fines hit €1.2 billion in 2024, and SOX violations can cost up to $5 million and carry criminal liability for executives. Beyond penalties, 62% of UK consumers say they would lose trust in a provider after a compliance breach, underlining how reputational damage can erode customer loyalty.

Operationally, compliance lapses are equally costly. Organizations with cybersecurity skills shortages suffer 20% higher breach costs, and breaches involving stolen credentials take an average of 292 days to identify and contain—amplifying both regulatory and financial consequences.

Technology Investment as a Strategic Necessity

To address these risks, financial firms are prioritizing technology. Around 40% of compliance budgets are now allocated to technology integration, reflecting a shift toward automation-first compliance frameworks. A 2025 forecast suggests that AI-powered compliance solutions could save US financial institutions $23.4 billion annually.

The global RegTech market, valued at $13 billion in 2023, is projected to surge to $82 billion by 2033. With 90% of financial institutions already using RegTech tools, it’s clear that manual compliance models are no longer viable.

Salesforce FSC: Market Leadership and Strategic Positioning

A Dominant Market Presence

Salesforce commands 21.8% of the global CRM market—more than its four top competitors combined. In 2024, the company reported $34.86 billion in revenue, driven by platforms like Service Cloud ($8.25B) and Sales Cloud ($7.58B)—both integral to FSC.

The adoption is significant: 83% of US financial institutions leverage FSC, reflecting broad market confidence. With more than 150,000 businesses globally using Salesforce, institutions benefit from continuous innovation and strong network effects.

Industry-Specific Architecture

Unlike generic CRM platforms, FSC offers financial-services-specific data models with objects such as Financial Accounts, Relationship Groups, and Households. These accommodate the sector’s unique complexities in client relationships, lending, underwriting, and policy servicing.

Through integrations with legacy platforms using MuleSoft and APIs, FSC allows firms to modernize without abandoning critical systems, a vital advantage for institutions still reliant on decades-old technology.

Compliance-First Design Philosophy

FSC differentiates itself through a compliance-first architecture. With built-in encryption, audit trails, and role-based access controls aligned to GDPR, SOC 2, ISO 27001, and PCI DSS, the platform ensures compliance is baked into operations rather than retrofitted as an afterthought.

Understanding Compliant Data Sharing (CDS) in FSC

Core Functionality

Compliant Data Sharing (CDS), introduced in Salesforce’s Winter ’21 release, enables institutions to enforce advanced data sharing rules without heavy coding. It allows administrators to precisely control what data is shared, with whom, and under what conditions, while maintaining full auditability.

CDS uses a participant-role framework that differs from traditional Salesforce models. Administrators create participant roles defining access levels, and users assign participants to records based on those roles. This enforces consistent compliance policies across the organization.

Technical Implementation Framework

CDS functions through organization-wide sharing defaults and share table entries that activate when participant role access exceeds baseline defaults. Currently, Financial Deal, Account, and Opportunity objects support CDS, with more in development.

Implementation involves five key steps: enabling CDS for objects, creating participant roles, assigning permissions, updating layouts, and configuring audit trails. This requires collaboration between compliance leaders, admins, and end-users.

Participant Role Management

Participant roles are business-aligned rather than purely technical. Institutions might define roles like “Approved Analyst,” “Compliance Officer,” or “External Advisor” with mandatory approval workflows for sensitive data. This ensures that sharing decisions not only meet business needs but also regulatory requirements.

Also Read – What Is a Household in Salesforce Financial Services Cloud?

Advanced Security and Audit Capabilities

Salesforce Shield Integration

Salesforce Shield strengthens FSC with three key features:

- Platform Encryption: Protects sensitive data such as PII and financial records at rest.

- Event Monitoring: Tracks user actions, API calls, and data exports in real-time to prevent insider threats.

- Field Audit Trail: Preserves historical data for up to 10 years, ensuring compliance with long-term recordkeeping requirements.

Comprehensive Audit Trail Framework

FSC automatically logs every interaction, email, call, meeting, and task, linking them to specific households or clients. This eliminates manual gaps while providing regulator-ready documentation.

Audit logs capture transaction changes, authorizations, timestamps, and user identities, creating immutable compliance records essential for both internal and external audits.

Role-Based Access and Data Masking

CDS enables granular permissions—restricting data to specific roles, client groups, or records. Sensitive fields like Social Security numbers or balances can be masked, allowing employees to work efficiently without exposing unnecessary details. This multi-layered security ensures compliance even in complex organizations.

Regulatory Compliance and Risk Management

Multi-Framework Compliance Support

FSC is built to address multiple regulations simultaneously, ensuring coverage for:

- GDPR: Data subject rights and consent tracking.

- CCPA: Transparency and customer disclosure requirements.

- PCI DSS: Cardholder data protection standards.

- SOX: Financial integrity and internal controls.

The platform provides automated disclosure tracking for regulations like Regulation BI and NAIC suitability standards, while workflow automation ensures compliance with Section 404 SOX requirements.

Risk Assessment and Mitigation

Compliance leaders benefit from supervision dashboards that highlight anomalies in real time, track approval turnaround times, and provide visibility into advisor activities.

FSC’s case management system streamlines compliance investigations by creating a complete digital paper trail for each escalation, supporting both internal audits and external regulators.

Automated Compliance Workflows

With prebuilt approval workflows, FSC automates oversight for disbursements, policy changes, account rollovers, and trades. Workflows can be configured by role, transaction size, or client type, ensuring consistent compliance.

Dynamic forms further reduce errors by collecting the required documentation during client onboarding and product enrollment, lowering the risk of missed disclosures.

Implementation Strategies and Best Practices

Phased Implementation

Firms achieve greater success when they begin with high-value use cases such as Accounts and Opportunities, and then scale toward complex objects like Financial Deals.

Clean, well-structured data is foundational. Institutions should audit and cleanse existing data before deployment to ensure CDS and AI-driven insights deliver accurate outcomes.

Change Management

Employee adoption is as critical as the technology itself. Training programs should highlight how FSC’s automation supports staff rather than replaces them, while ongoing refreshers keep employees aligned with evolving compliance best practices.

Cross-departmental collaboration is another priority—FSC enables wealth managers, loan officers, and service reps to work from a single unified view of client data, reducing silos.

Integration Architecture

Many institutions rely on legacy core banking systems. By using middleware like MuleSoft or Dell Boomi, FSC integrations can be phased in, reducing risk.

Institutions should also review API limitations upfront and engage IT leaders to resolve integration challenges before rollout.

Also Read – The Architecture of Salesforce Financial Services Cloud

Measuring ROI and Business Impact

Quantifiable Benefits

Organizations implementing compliant data sharing frameworks see 25–40% improvements in data quality metrics such as accuracy, completeness, and consistency within the first year.

Firms leveraging automation also report lower breach costs by an average of $2.2 million, alongside better audit readiness scores and fewer compliance violations.

Operational Efficiency Gains

FSC adoption drives clear operational wins:

- Loan processing times reduced by up to 45%.

- Customer satisfaction up by 40%.

- Manual workload reduced by 35% through automation.

These efficiencies translate into faster service delivery, lower costs, and more engaged clients.

Long-Term Strategic Value

Beyond compliance, FSC builds strategic advantages. With its 360-degree customer view, institutions can deliver personalized recommendations, anticipate client needs, and unlock new cross-sell opportunities. Over time, this leads to higher retention rates and stronger revenue growth.

Emerging Trends and Future Outlook

AI and Automation

With Salesforce’s Agentforce capabilities (introduced in 2025), financial institutions can leverage AI agents for compliance monitoring and testing. Features like Einstein Trust Layer field masking automate sensitive data protection across the organization.

RegTech Evolution

The RegTech market is set to grow to $82 billion by 2033, fueled by AI and blockchain. AI is already reshaping fraud detection, transaction monitoring, and compliance reviews, while blockchain-based immutable ledgers are streamlining audit transparency.

Regulatory Shifts

Upcoming changes like Basel III Endgame, open banking mandates, and AI governance frameworks will reshape compliance expectations. FSC’s compliance-first design allows firms to adapt quickly to evolving requirements, minimizing disruption.

Strategic Implementation Roadmap

Phase 1: Assessment and Planning

Start with a compliance assessment to identify gaps and establish governance frameworks. Baseline measures should include data quality scores, compliance costs, and efficiency metrics.

Technology readiness reviews should evaluate current systems, integration capacity, and team skills before deployment.

Phase 2: Pilot Implementation

Pilot use cases should target low-risk, high-impact areas, like Account and Opportunity objects. Early success metrics should combine both technical KPIs (data accuracy, audit readiness) and business KPIs (customer satisfaction, process efficiency).

Phase 3: Scaling and Optimization

Once pilots prove successful, expand across departments and add objects. Ongoing change management and continuous improvement cycles ensure compliance frameworks remain aligned with evolving regulations and business needs.

Conclusion

With average breach costs topping $6 million and compliance budgets rising 25% annually, manual compliance methods are unsustainable. FSC offers compliant data sharing, role-based access, automated workflows, and audit trails, empowering firms to reduce compliance risks, improve efficiency by 35%, and deliver better customer experiences.

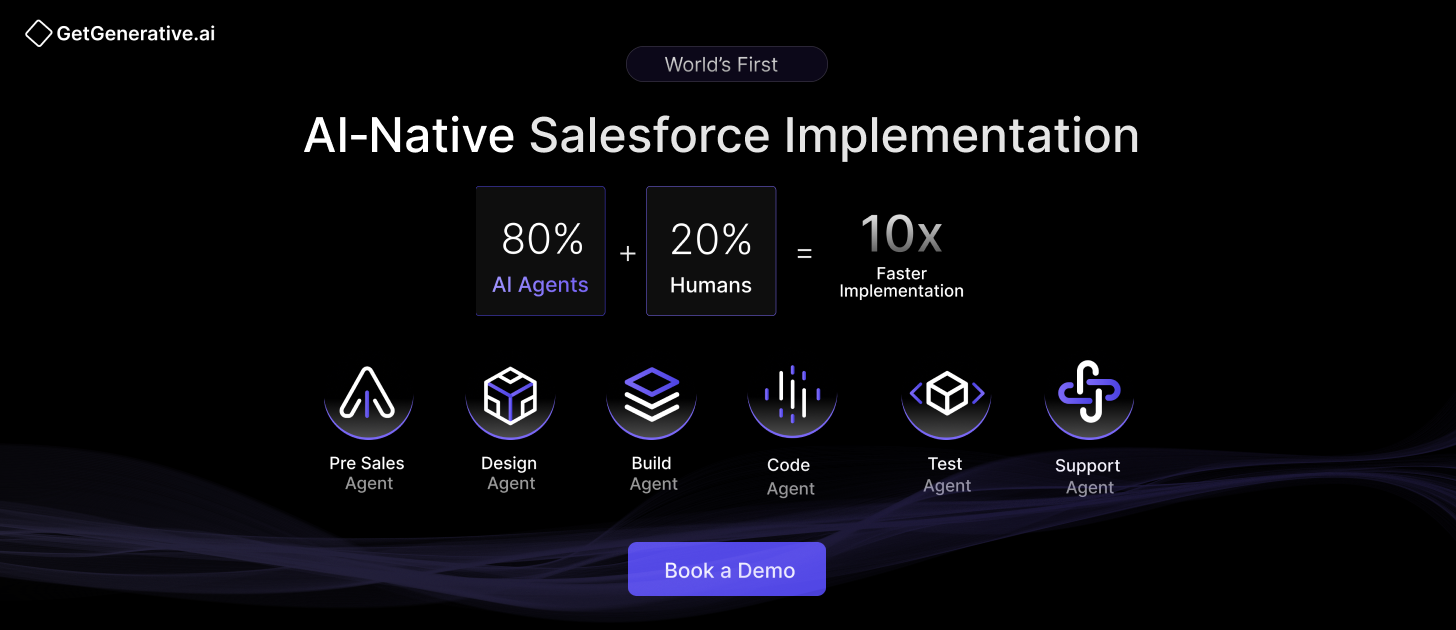

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services