Key Considerations for a Successful Salesforce Financial Cloud Implementation

Implementing Salesforce Financial Cloud successfully isn’t just about activating licenses or installing features—it requires strategic planning, clean data, and a cross-functional approach.

This guide outlines the key considerations that can make or break your Salesforce Financial Services Cloud implementation in 2025.

1. Strategic Planning: Set the Foundation Early

Understand Your Business Needs

Start with a deep dive into your current operations. Map out critical workflows, pain points, and bottlenecks. Ask:

Where are inefficiencies costing time or money?

Which client experiences need improvement?

These insights will guide what FSC features to prioritize—whether it’s lead management, onboarding automation, or compliance reporting.

Define Measurable Goals

Don’t just say “we want to improve.” Quantify your goals. Examples:

Improve lead response time by 30%

Reduce onboarding time from 7 days to 3 days

Increase advisor productivity by 20%

These benchmarks will serve as your north star throughout the project.

Build a Cross-Functional Team

A successful FSC implementation involves more than just IT. Bring together:

Financial advisors who understand customer workflows

IT teams who manage data and integration

Project managers to align timelines and stakeholders

Cross-functional collaboration ensures no critical piece is overlooked.

2. Data Preparation and Migration: Clean, Migrate, Validate

Start With Clean Data

Data is your most valuable asset. Begin by:

Removing duplicates

Standardizing formats

Verifying completeness

Clean data is key to accurate reporting, meaningful insights, and user trust.

Don’t Delay Data Planning

Many implementations falter because data migration is treated as an afterthought. Start early:

Define data sources and fields to migrate

Identify data owners for validation

Establish mapping rules between legacy systems and FSC

Test Before You Go Live

Before migrating production data, run trial migrations with test datasets. This helps validate:

Field-level mapping

Workflow compatibility

Overall system performance

Related Read – Salesforce Financial Cloud Implementation Guide

3. Smart Customization and Configuration

Configure First, Customize Second

Salesforce Financial Services Cloud comes with powerful out-of-the-box features tailored to the financial sector. Leverage them before jumping to custom code.

Avoid Over-Customization

While it’s tempting to tweak every workflow, too many customizations can:

Increase technical debt

Complicate future upgrades

Drive up implementation costs

Focus on business-critical enhancements and use Salesforce’s declarative tools whenever possible.

4. Seamless System Integration

Identify What Needs to Connect

Determine which internal and third-party systems must integrate with FSC:

Core banking or insurance systems

Document repositories

Customer communication tools

Marketing automation platforms

Choose the Right Integration Approach

Your integration method should balance cost, complexity, and performance:

Salesforce APIs: Ideal for standardized, scalable integration.

MuleSoft or other connectors: Great for rapid, low-code integration across systems.

Custom Integration: When business logic is highly specialized or connectors are unavailable.

5. Change Management and User Training

Train Early and Often

Training should be hands-on, role-based, and continuous. Use:

Interactive workshops

LMS-hosted video tutorials

Live Q&A sessions

Overcome Resistance to Change

Employees may hesitate to adopt a new system. Mitigate this by:

Involving them in the early stages of planning

Clearly explaining benefits (less manual work, better visibility, etc.)

Providing ongoing support

6. Regulatory Compliance and Security

Stay Aligned with Financial Regulations

FSC supports compliance with major frameworks like GDPR and CCPA, but regional or sector-specific rules may apply. Ensure configurations support:

Audit trails

Consent management

Data retention policies

Strengthen Data Access and Security

Use role-based access control (RBAC) to limit sensitive data exposure. Also consider:

Two-factor authentication

IP restrictions

Shield Platform Encryption for data at rest and in transit

7. Testing and Quality Assurance

Run Pilot Programs

Before company-wide rollout, run pilots with a controlled group. Focus on:

Day-to-day workflows

Data accuracy

User feedback

Use Realistic Test Scenarios

Simulate real business use cases like:

Opening new financial accounts

Processing loan applications

Assigning leads to advisors

This helps validate both system readiness and business fit.

8. Post-Launch Support and Optimization

Monitor System Performance

After go-live, track metrics such as:

User adoption rate

Case resolution time

System uptime

Use this data to identify gaps and areas for optimization.

Leverage Salesforce Support Resources

Utilize:

Salesforce Trailhead for ongoing learning

Partner support teams for complex issues

Product documentation and release notes for continuous improvements

9. Measure Success and ROI

Track Financial and Operational KPIs

Quantify your return by measuring:

Revenue growth per advisor

Client satisfaction scores

Cost-to-serve reductions

Align Outcomes with Strategic Goals

Ultimately, FSC should help you:

Deliver superior customer experiences

Improve compliance reporting

Scale your business with confidence

If it’s not driving your business strategy forward, revisit your configuration and training approach.

Also Read – Key Features of Salesforce Financial Services Cloud

Conclusion

Implementing Salesforce Financial Cloud is a strategic investment that can transform financial operations and enhance client experiences. You can ensure a successful implementation that drives measurable results by following these considerations: data preparation, thoughtful customization, robust training, and compliance focus.

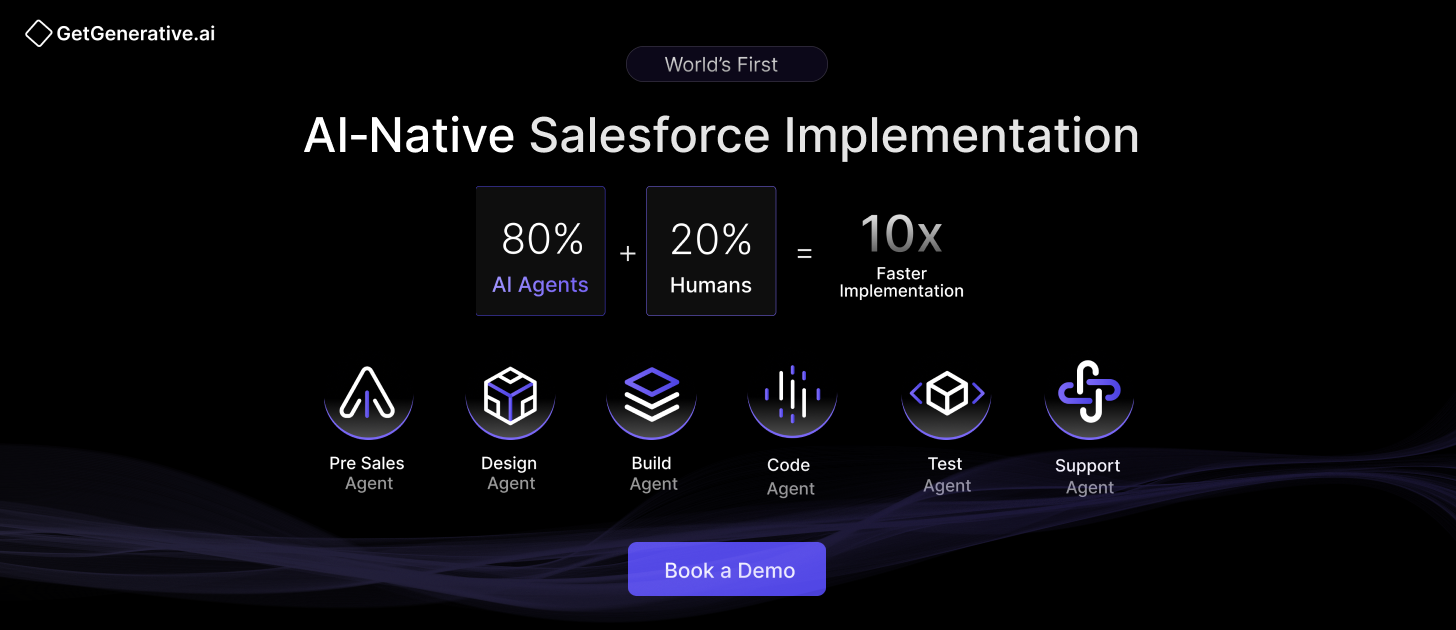

At GetGenerative.ai, our proprietary AI platform powers purpose-built Agents that automate your entire Salesforce implementation, while our top 1% global experts provide oversight, strategy, and quality control.

10x faster. AI-first. Human-reviewed.

👉 Explore our AI Salesforce Consulting Services

FAQs

1. What is Salesforce Financial Cloud used for?

Salesforce Financial Cloud helps financial institutions manage client relationships, automate workflows, and ensure regulatory compliance.

2. How long does implementation typically take?

The timeline varies but generally ranges from 3 to 12 months, depending on complexity and customization.

3. Is customization mandatory for Salesforce Financial Cloud?

While not mandatory, customization helps align the platform with your specific business needs for maximum efficiency.