Salesforce Financial Services Cloud For Insurance Service

According to industry studies, fewer than 50% of insurance customers are fully satisfied with their provider, and 46% say they would stay loyal to a financial services firm that delivers excellent digital experiences—even if fees increase. This growing demand for 24/7 service, mobile access, and hyper-personalized interactions is pushing insurers to adopt platforms that can modernize every touchpoint.

Enter Salesforce Financial Services Cloud (FSC) — a purpose-built CRM platform that redefines how insurance providers operate. Unlike generic CRM tools, FSC integrates deeply with insurance-specific workflows, data models, and AI capabilities. It unlocks siloed systems and helps insurers offer real-time, personalized, and compliant services at scale.

The Digital Imperative in Insurance

1. Evolving Customer Expectations

Modern insurance customers expect seamless digital experiences—comparable to those offered by top fintech or e-commerce platforms. This includes:

- Instant quotes

- Mobile-first claims

- AI-powered support

- Personalized coverage recommendations

Salesforce research shows that 65% of customers now expect faster service through AI, a significant jump from 46% in 2023. The demand for 24/7 digital assistance, proactive advice, and frictionless interactions is no longer optional—it’s the baseline.

2. Industry Challenges

Despite this shift, many insurers still run on legacy tech stacks and disjointed platforms, such as separate systems for policy administration, CRM, and billing. Salesforce found that insurance brokerages typically use three or more systems just to service clients, leading to slow service, errors, and compliance issues.

Additional pain points include:

- Cybersecurity concerns due to fragmented data

- Strict regulatory frameworks requiring transparent data handling

- Talent shortages in AI, analytics, and automation domains

Insurance firms now need an integrated, secure, and intelligent platform that enables productivity while ensuring trust and compliance.

What Is Salesforce Financial Services Cloud (FSC)?

Salesforce Financial Services Cloud is a specialized CRM built for financial institutions—specifically banking, wealth, and insurance. FSC transforms traditional CRM by embedding:

- Prebuilt insurance data models

- Custom workflows for policy, claims, and commissions

- AI-powered automation

- 360° customer profiles

Unlike other CRMs, FSC includes out-of-the-box insurance objects such as:

- Policies

- Claims

- Coverages

- Life Events

- Commissions

- Households

These standard components connect seamlessly to deliver a unified policyholder view and streamline every aspect of insurance service delivery.

Also Read – Key Features of Salesforce Financial Services Cloud

Insurance-Specific Capabilities of Salesforce FSC

1. Unified Policyholder 360° View

FSC consolidates policyholder data into a single customer profile. All information—life, auto, health, or property policies, along with claims history and interaction logs—are readily accessible.

Use Case:

Pacific Life implemented FSC to create a central data hub, providing agents real-time access to customer profiles across regions, improving service personalization and efficiency.

2. Policy and Claims Management

FSC automates complex policy lifecycles and claims processing. With Lightning Flows and prebuilt templates, service reps can handle requests like First Notice of Loss or Beneficiary Changes without toggling between systems.

3. Commission and Channel Management

Brokers and carriers can define commission splits, automate payouts, and manage overrides—all within Salesforce. This replaces spreadsheets and ensures compliance with rules during agent transitions or policy changes.

4. Advisor Productivity and Service Console

Salesforce offers a Lightning Service Console tailored to insurance advisors with real-time dashboards, case management, and integrated omnichannel communications (email, chat, voice).

5. Analytics and AI-Powered Insights

FSC includes prebuilt reports for:

- Policy sales

- Renewal rates

- Claims volumes

- Agent performance

With Einstein AI and Tableau CRM, insurers can identify trends, automate next-best actions, and predict customer churn or fraud.

6. Multi-Channel Customer Experience

With Experience Cloud, FSC lets insurers create self-service portals where policyholders can:

- File claims

- Access policy documents

- Request endorsements

All interactions are tracked, enabling omnichannel engagement with full context.

7. Embedded AI and Agentforce Capabilities

Salesforce’s Agentforce introduces autonomous AI agents that can:

- Process entire small claims

- Generate risk scores for underwriting

- Handle policyholder inquiries via chatbots or voice bots

Salesforce FSC for Insurance Brokerages (2025 Edition)

In October 2024, Salesforce launched the Financial Services Cloud for Insurance Brokerages, available broadly in February 2025. This specialized edition targets agencies and brokers with tailored functionality, including:

1. AI-Driven Client Engagement

Using Salesforce Data Cloud, the brokerage edition offers real-time client profiles, alerts on expiring policies, and AI-based retention risk scoring.

Benefit: Account managers can proactively recommend new coverages or schedule follow-ups to reduce churn.

2. Commission Automation Engine

Brokerages with multi-agent policies benefit from a rules-based commission engine. Salesforce automates commission allocations even if producers exit or are reassigned.

3. Employee Benefits Management

FSC tracks:

- Renewal cycles

- Plan options

- Workforce demographics

AI-driven suggestions help brokers advise employer clients with smarter plan recommendations.

4. Property & Casualty (P&C) Servicing

Specialty brokers (e.g., maritime, fleet, or real estate) gain property detail dashboards. FSC connects multiple carrier systems into one view for real-time updates, compliance, and advice.

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Business Benefits and Strategic Impact of FSC

1. Operational Efficiency and Cost Reduction

FSC eliminates manual processes and system sprawl through automation and integration. Common use cases include:

- Automated beneficiary updates

- Policy renewals with zero manual follow-up

- Lightning flows for claims processing

This automation enables insurers to reallocate their human capital toward higher-value roles, such as underwriting, relationship management, and sales.

2. Enhanced Customer Experience and Loyalty

FSC helps insurers provide hyper-personalized service by enabling a 360° view of policyholders. With omnichannel integration (portal, phone, chat), agents can respond in context, eliminating the need for customers to repeat details.

3. AI-Powered Decision-Making and Risk Management

With FSC + Einstein Analytics:

- Identify churn-prone customers early

- Score risk in underwriting using past data

- Automate case routing based on claim type and history

4. Revenue Growth Through Cross-Selling and Upselling

With unified data and AI, insurers can identify unmet customer needs, such as:

- Life insurance for customers with only auto coverage

- Group policies for clients nearing HR benefits renewals

Using Marketing Cloud, insurers can automate outreach with personalized, data-driven campaigns that increase conversion.

5. Improved Compliance and Trust

FSC embeds robust data governance, identity verification, and field-level security—essential in a highly regulated industry. Automated flows enforce:

- Consent collection before policy issuance

- Agent license verification

- Commission audit trails

Conclusion

Salesforce Financial Services Cloud is more than a CRM—it’s a digital transformation platform engineered for the complexities of insurance.

Your competitors are already investing. The leaders of 2025 and beyond will be those who not only adopt Salesforce FSC but also embed it at the heart of every interaction, transaction, and relationship.

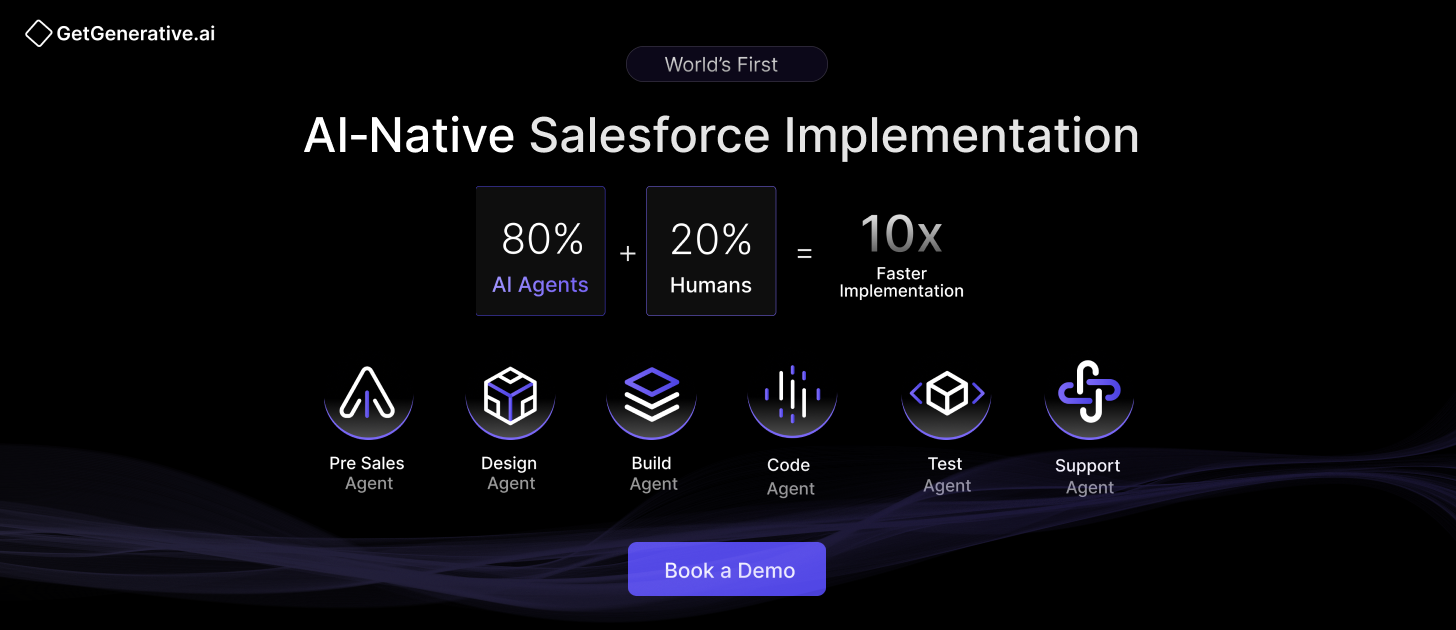

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services