Salesforce Financial Services Cloud for Mortgage Lending

The mortgage lending landscape in 2025 is undergoing a fundamental transformation. Rising operational costs, increased regulatory scrutiny, and the digital expectations of modern borrowers are pushing traditional lenders to rethink their technology stacks.

Salesforce Financial Services Cloud (FSC) is a platform purpose-built to modernize mortgage operations, reduce inefficiencies, and elevate customer experiences.

Why Mortgage Lending Needs Urgent Transformation

Today, the mortgage industry faces sobering challenges:

- Average processing time: 46 days per loan

- Cost per loan: $7,000–$9,000

- Customer satisfaction score: Just 727/1000 (J.D. Power, 2024)

In an environment where digital-first competitors are gaining ground, these numbers are no longer acceptable. Implementing Salesforce FSC has helped some lenders reduce loan processing times by up to 45%, slash operational costs, and improve customer engagement significantly.

The Mortgage Industry’s Digital Crossroads

A. Key Pain Points Crippling Lenders

- Processing inefficiencies: Fragmented systems and manual processes are slowing down approvals and increasing error rates.

- Compliance complexity: Regulations like TRID (TILA-RESPA Integrated Disclosure) mandate exact disclosures and timelines, with violations ranking among the top CFPB citations in 2023.

- Customer experience gap: Only 37% of home buyers are digital-first, but these younger borrowers demand mobile-friendly, real-time, and transparent processes.

B. Market Trends Accelerating Change

- Digital mortgage software market: Valued at $3.7 billion in 2022, forecasted to reach $35.3 billion by 2032.

- AI adoption in mortgage lending: Jumped from 15% in 2023 to 38% in 2024

- Lender market growth: The global mortgage lending industry stands at $15.4 billion (2024), growing at 4.8% annually

The message is clear: digital transformation isn’t a choice—it’s a necessity.

Also Read – Key Features of Salesforce Financial Services Cloud

Salesforce FSC: The Mortgage Engine for the Future

A. What Sets FSC Apart

Salesforce FSC goes beyond traditional CRM systems by offering an industry-specific data model, eliminating the need for heavy customization. It includes:

- Prebuilt objects for loan applications, borrower relationships, and compliance tracking

- Einstein AI for lead scoring, automated underwriting, and predictive insights

- An Actionable Relationship Center for a 360-degree customer view

These features enable loan officers to personalize borrower experiences, uncover cross-sell opportunities, and streamline end-to-end loan management.

B. Built-In Mortgage Capabilities

Salesforce FSC delivers a robust toolkit tailored specifically for mortgage operations:

Feature | Description |

Mortgage data model | Specialized objects for loan apps, borrowers, and documentation |

Guided loan application flows | Customizable, compliant workflows per loan product |

Document tracking | Automated reminders, review routing, and completion status |

AI-driven underwriting | ML-powered decision-making with 30–50% time savings |

Strategic Benefits of FSC Implementation

A. Operational Efficiency Gains

Salesforce FSC offers lenders tangible, bottom-line benefits:

- Loan processing time: ↓ 45%

- Underwriting effort: ↓ 30–50%

- Operational cost: ↓ 20%, according to McKinsey

- Scalability: Cloud-native architecture handles volume spikes with no extra staffing

B. Superior Customer Experience

By leveraging FSC, lenders transform the borrower journey:

- Real-time updates and self-service portals reduce anxiety and loan officer workload

- Personalized outreach based on borrower data improves conversion and satisfaction

- Mobile-first interactions make the experience seamless and modern

C. Competitive Advantage

FSC arms lenders with technology capabilities that are hard to replicate:

- Tech differentiation: Rapid deployment of digital services

- Regulatory readiness: Automated compliance tracking and audit trails

- Market agility: Easy product rollout and pricing adjustments

Also Read – Salesforce Financial Services Cloud For Insurance Service

Implementation Strategy: From Vision to Value

A. Phase 1: Assessment and Planning

- Process Mapping: Identify inefficiencies and define success metrics

- Data Strategy: Plan for secure, accurate data migration and integration

- Stakeholder Alignment: Ensure business and IT are working toward shared goals

B. Phase 2: Phased Rollout

A typical roadmap looks like:

- Core CRM & workflow automation – unify customer data, streamline tasks

- Mortgage-specific modules – implement loan app flows, document management, AI tools

- Advanced analytics & integrations – predictive modeling, third-party system syncing

This staggered approach ensures quick wins, minimizes disruptions, and builds momentum for deeper transformation.

Integrations That Multiply Value

Integration | Value |

Loan Origination Systems (LOS) | Real-time syncing to eliminate re-entry and silos |

Credit bureaus & verifiers | Instant data validation and risk scoring |

Core banking systems | Complete customer financial view for better cross-selling |

AI-Powered Lending: From Reactive to Predictive

A. Artificial Intelligence in Action

Salesforce FSC’s integration with Einstein AI shifts lenders from reactive service models to proactive, intelligent engagement:

AI Use Case | Impact |

Automated Underwriting | ML algorithms assess borrower data, cutting processing time by 30–50% |

Fraud Detection | Pattern recognition reduces fraudulent applications by up to 50% |

Lead Scoring & Recommendations | Intelligent scoring improves sales velocity and loan officer productivity |

Predictive Insights | Anticipate borrower needs and prevent churn through proactive outreach |

These tools enable lenders to make faster, more accurate decisions while reducing the burden on underwriters.

B. Intelligent Document Processing & Automation

Manual document handling is a bottleneck. FSC resolves this through:

- OCR & NLP: Auto-extracts borrower data from scanned forms

- Compliance Automation: Validates applications against TRID, internal policies, and investor criteria

- Workflow Orchestration: Routes tasks based on logic, escalates exceptions, and improves turnaround time

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Real-Time Analytics for Smarter Decisions

A. Operational Dashboards

FSC delivers real-time performance monitoring for:

- Loan pipeline status

- SLA adherence

- Compliance metrics

- Application bottlenecks

These dashboards empower managers to take immediate action when KPIs are off-target.

B. Customer Analytics

Understanding customer behavior is key to differentiation. FSC enables:

- Journey Mapping: Visualize where prospects drop off and optimize accordingly

- Personalization Triggers: Offer the right product at the right time

- Lifecycle Analysis: Target cross-sell opportunities based on borrower stage

C. Predictive Modeling

FSC helps future-proof your strategy with:

- Market Forecasting: Price sensitivity, demand shifts, rate impact

- Risk Identification: Spot at-risk loans before they default

- Revenue Optimization: Model pricing, incentive strategies, and portfolio health

Regulatory Compliance & Risk Management

A. TRID Compliance Automation

FSC addresses TRID’s timing and accuracy demands with:

- Loan Estimate Generation: Automatically created within 3 business days of application

- Disclosure Tracking: Monitors every touchpoint, preventing missed deadlines

- Closing Disclosure Management: Ensures data accuracy, syncs with all parties, and supports the mandatory 3-day review period

This reduces violations while preserving borrower trust.

B. Risk Mitigation & Audit Trails

FSC enables proactive risk management:

- Risk Scoring: Uses both traditional credit data and alternative sources

- Portfolio Monitoring: Alerts for performance dips or concentration risks

- Complete Audit Trails: Log every change, communication, and decision point—crucial for CFPB or investor audits

C. Enterprise-Grade Data Security

Financial institutions face stringent data privacy laws. FSC is built to comply:

- Multi-Factor Authentication & Role-Based Access Control

- AES-256 Encryption (at rest and in transit)

- Consent Management tools for borrower privacy preferences

- Audit Logging for regulatory compliance and accountability

Calculating ROI: Tangible Gains & Strategic Growth

A. Quantifiable Results

KPI | Traditional | With FSC | Improvement |

Processing Time | 46 days | 25–28 days | ↓ 45% |

Cost per Loan | $7,000–$9,000 | ↓ 20% | ~$1.4M–$1.8M annual savings (1,000 loans/month) |

Customer Satisfaction | 727/1000 | ↑ Significantly | Improved NPS, CSAT |

Digital lenders using FSC report 15–20 day faster turnaround, giving them a huge edge in competitive markets.

B. Strategic Advantages

- Digital Differentiation: Beat fintechs at their own game with faster, smarter workflows

- Market Expansion: Serve underserved segments profitably with automation

- Revenue Growth: Cross-sell based on data-driven insights, increase customer lifetime value

Understanding FSC Implementation Costs & Timeline

Component | Typical Range |

License Fee | $150–$300/user/month (volume-based) |

Implementation Services | 2x–4x annual license cost |

Payback Period | 6–24 months (depending on deployment scope) |

The initial investment pays off quickly through cost savings, faster processing, and increased loan volume. Total Cost of Ownership (TCO) is further reduced by retiring legacy systems and minimizing IT support costs.

Also Read – Why Salesforce Developers Still Matter in an AI World

The Future of Mortgage Lending with FSC

A. Emerging Technologies on the Horizon

- Blockchain: Immutable property records, automated escrow via smart contracts

- NLP: Conversational loan applications, automated policy reading

- IoT Data Integration: Real-time property value inputs from smart home sensors

Salesforce’s innovation roadmap ensures FSC will continue evolving to support these next-gen capabilities.

B. Evolving Regulatory Standards

- AI Governance: Transparent algorithms, explainable AI requirements

- Digital Disclosure Norms: eConsent, digital document tracking

- Data Privacy Laws: Increasingly complex—FSC’s built-in tools ease compliance

C. Competitive Shifts & Fintech Collaboration

- Expect consolidation: Tech-savvy lenders will outpace slow adopters

- New fintech partnerships: FSC’s open architecture makes integrations seamless

- Customer expectations: Continuously rising—FSC helps keep up

Conclusion

The mortgage industry is at a breaking point—46-day cycles, $9,000 per loan, and dissatisfied borrowers are no longer sustainable. Salesforce Financial Services Cloud offers an end-to-end solution that addresses today’s operational inefficiencies while future-proofing your business.

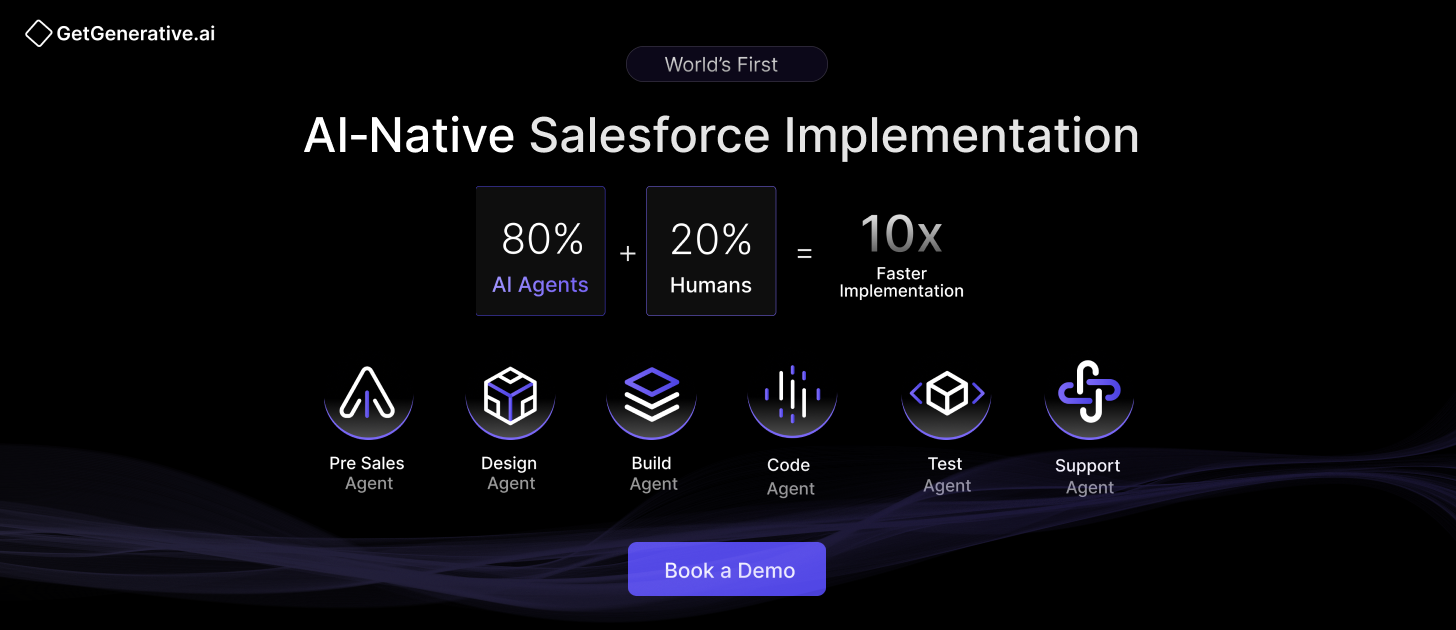

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services