Salesforce Financial Services Cloud: Record Alerts Explained

Research shows that 73% of customers are more likely to remain loyal to companies that anticipate their needs and act proactively. Delivering the right information at the right moment can turn a routine interaction into a relationship-strengthening opportunity—or stop a minor issue from escalating into a crisis.

This is exactly where Salesforce Financial Services Cloud (FSC) Record Alerts prove invaluable. With the global finance cloud market valued at $32.8 billion in 2024 and forecasted to grow at a CAGR of 22.7% through 2034, intelligent alerting systems are becoming indispensable for financial institutions aiming to stay ahead.

Salesforce FSC, already a market leader in CRM for financial services, takes notifications far beyond simple pop-ups. Record Alerts form a proactive intelligence layer that helps advisors and relationship managers anticipate client needs, strengthen compliance, and create personalized client experiences.

What Are Record Alerts?

Record Alerts are intelligent notifications in Salesforce Financial Services Cloud that highlight significant changes or actions required on client records. Unlike generic system messages, these alerts are tailor-made for the financial services industry, where context, personalization, and timing are vital.

They act as a real-time intelligence layer, pulling data from multiple sources, core banking systems, wealth management platforms, credit bureaus, and Salesforce records to surface actionable insights exactly when they’re needed.

The Architecture of FSC Record Alerts

The sophistication of Record Alerts lies in their design. They are highly configurable and structured for maximum clarity and actionability.

Core components include:

- Actions – Advisors can dismiss, snooze, or escalate alerts.

- Active Status – Tracks whether the alert is still relevant.

- Description – Provides a clear explanation of the alert.

- Severity Levels – Alerts can be classified as Error, Warning, Info, or even custom-defined.

- Source Identification – Displays whether the alert originated internally within Salesforce or from an external system.

API-powered integrations further extend this architecture, pulling data seamlessly from third-party financial platforms and creating a unified view of client activities.

Why Intelligent Alerting Matters

Digital Transformation Pressure

The Salesforce FSC market growth highlights a shift toward proactive client engagement rather than reactive problem-solving.

Key drivers include:

- Rising client expectations for personalized service.

- Increasing regulatory compliance requirements.

- The need for competitive differentiation in saturated markets.

- Pressure to automate routine monitoring and free up advisor bandwidth.

The Cost of Staying Reactive

Without intelligent alerts, institutions risk:

- Missed revenue opportunities – Overlooking signals for cross-selling or upselling.

- Compliance gaps – Failing to detect suspicious or high-risk activities quickly.

- Client churn – Losing customers due to unresolved issues.

- Advisor inefficiency – Excessive time spent on manual monitoring.

CRM studies show that while Salesforce implementations yield a positive ROI within 12–13 months and an average of 299% ROI over three years, the true differentiator lies in shifting from reactive to proactive client management.

Also Read – The Architecture of Salesforce Financial Services Cloud

The Technology Behind Record Alerts

Salesforce FSC’s Record Alerts use a multi-layered technology stack:

- OmniStudio Integration – FlexCards provide rich, interactive alert displays with contextual actions.

- Business Rules Engine – Complex logic can combine multiple conditions (e.g., balance below threshold and recent overdraft fees).

- Data Consumption Framework – Connects Salesforce with external systems asynchronously, pulling in data from banking cores, credit agencies, or insurance systems.

Alert Categories and Severity Levels

Record Alerts can be configured to suit different use cases:

- Error Alerts – Critical issues like compliance violations or high-risk transactions, requiring immediate action.

- Warning Alerts – Cautionary signals such as clients nearing credit limits or overdue payments.

- Informational Alerts – Non-urgent updates like anniversaries or service notifications.

- Custom Alerts – Tailored severity values aligned with institutional risk appetite.

This flexibility ensures that alerts are meaningful and aligned to business objectives, avoiding alert fatigue.

Integration and Hierarchical Views

Another powerful capability of FSC Record Alerts is contextual visibility across multiple entity types:

- Financial Account Alerts – Notify on account-level activities like threshold breaches or unusual transactions.

- Person Account Alerts – Capture client-specific events such as life milestones or relationship changes.

- Aggregated Views – Hierarchical groupings allow advisors to see how multiple alerts interrelate for a single client.

This hierarchy ensures that financial advisors don’t just see fragmented notifications—they gain holistic insight into client needs and risks.

Business Impact: From Risk Management to Revenue

Fraud Detection and Risk Control

With cyber threats on the rise—ransomware attacks in banking alone increased by 30% year-over-year—Record Alerts serve as an early warning system. Suspicious transaction patterns can immediately trigger alerts, enabling faster investigations and reducing compliance risk.

Relationship Strengthening

Record Alerts prompt outreach when engagement drops, or surface life events like marriage or career changes, creating opportunities for personalized financial planning.

Revenue Generation

Alerts also fuel cross-selling by highlighting when clients are primed for new products. For example, one mid-sized credit union using FSC saw a 27% increase in satisfaction scores and a 15% productivity boost by leveraging Record Alerts.

Also Read – Salesforce Financial Services Cloud for Mortgage Lending

Implementation Strategy: Best Practices for Success

Phase 1: Planning and Preparation

- Stakeholder Alignment – Involve senior leadership, advisors, service teams, and IT to define clear objectives.

- Data Strategy – Map and cleanse data across banking, wealth, and insurance systems for consistency.

- Compliance Framework – Define retention policies, audit processes, and regulatory alignment upfront.

Phase 2: Technical Configuration

- Permission Management – Use FSC-specific permission sets to balance accessibility with data security.

- Alert Criteria – Configure rules in the Business Rules Engine, ensuring relevance without overloading users.

- System Integration – Connect via the Data Consumption Framework or MuleSoft to pull in external financial data.

- UI Customization – Add FlexCards strategically on record pages so alerts are visible but not overwhelming.

Phase 3: Testing and Optimization

- Sandbox Testing – Validate logic and triggers before production rollout.

- User Acceptance Testing (UAT) – Engage advisors and service reps to confirm alerts support workflows.

- Performance Monitoring – Track resolution times, response rates, and accuracy.

Phase 4: Deployment and Adoption

- Phased Rollout – Start with pilot groups before full-scale launch.

- Training Programs – Educate teams on interpreting and acting on alerts.

- Change Management – Communicate benefits, address resistance, and share quick wins.

Phase 5: Continuous Improvement

- Regularly refine alert logic based on user feedback.

- Add new integrations and advanced alert types as needs evolve.

- Document and share best practices across teams.

Also Read – Salesforce UAT Best Practices for Smooth Go-Live

Security and Compliance: Safeguarding Client Data

Financial institutions must protect sensitive data while leveraging Record Alerts.

- GDPR Compliance – Classify sensitive fields, restrict access, maintain audit trails, and support “Right to be Forgotten.”

- PCI DSS and SOX Requirements – Implement strong internal controls for payments and financial reporting.

- Encryption and MFA – Secure alert data at rest and in transit, with multi-factor authentication for all users.

- Regular Reviews – Conduct quarterly security and compliance audits to close gaps.

By embedding compliance into alert configuration, organizations reduce regulatory risk while ensuring client trust.

Competitive Landscape: FSC vs Alternatives

Salesforce FSC Advantages

- Pre-built financial services data model (accounts, holdings, relationships).

- Native compliance features and robust audit trails.

- 2,600+ AppExchange apps for extended capabilities.

- Advanced analytics with Einstein AI.

Microsoft Dynamics 365 Strengths

- Seamless integration with Office 365, Teams, and Power BI.

- Lower costs for organizations fully invested in Microsoft ecosystems.

- On-premise deployment options.

Emerging Fintech Platforms

- Agile, cloud-native players like Fin365 bring niche capabilities but lack global scalability and ecosystem maturity.

Bottom line: While Microsoft and fintech competitors have their appeal, Salesforce FSC remains the most industry-specific and scalable choice for complex, relationship-driven financial institutions.

ROI and Success Metrics

Institutions adopting Record Alerts consistently report measurable gains:

- Operational Efficiency – 25% reduction in IT operational costs and 26% productivity improvement.

- Customer Engagement – 25–30% higher client satisfaction scores post-implementation.

- Revenue Growth – 15–27% increase in product adoption and customer engagement.

Key Metrics to Track:

- Average alert resolution time.

- % of alerts leading to meaningful client interactions.

- Compliance incident reductions.

- Client retention and upsell rates.

Future Trends: Where Record Alerts Are Headed

- AI-Powered Proactivity

- Predictive alerts generated before issues arise.

- Natural Language Processing for advisor-friendly explanations.

- Machine learning to refine alerts based on past outcomes.

- Omnichannel Reach

- Mobile-first alerts for on-the-go advisors.

- Voice-enabled notifications through assistants.

- Push notifications via SMS, email, and in-app channels.

- RegTech Integration

- Automated compliance reports generated from alerts.

- Cross-border compliance logic embedded in real time.

- Continuous monitoring for regulatory changes.

Roadmap for Decision-Makers

- Months 1–2 – Assess current systems, align stakeholders, and define ROI targets.

- Months 3–4 – Design data architecture, configure rules, and establish security.

- Months 5–6 – Test, validate integrations, and optimize for workflows.

- Months 7–8 – Deploy with training and change management support.

- Months 9–12 – Monitor KPIs, refine alerts, and expand advanced features.

This phased approach ensures both short-term wins and long-term scalability.

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Common Challenges and How to Overcome Them

- Alert Fatigue – Prioritize high-impact alerts, customize by role, and review quarterly.

- Integration Barriers – Plan ahead for legacy system connections and data quality issues.

- User Adoption Resistance – Secure executive sponsorship, empower champions, and share success stories.

Conclusion

The financial services industry is at a crossroads. Institutions that embrace proactive, intelligent client engagement will outpace competitors in retention, compliance, and growth. Salesforce FSC Record Alerts are not just a notification system—they are a strategic enabler of modern relationship management.

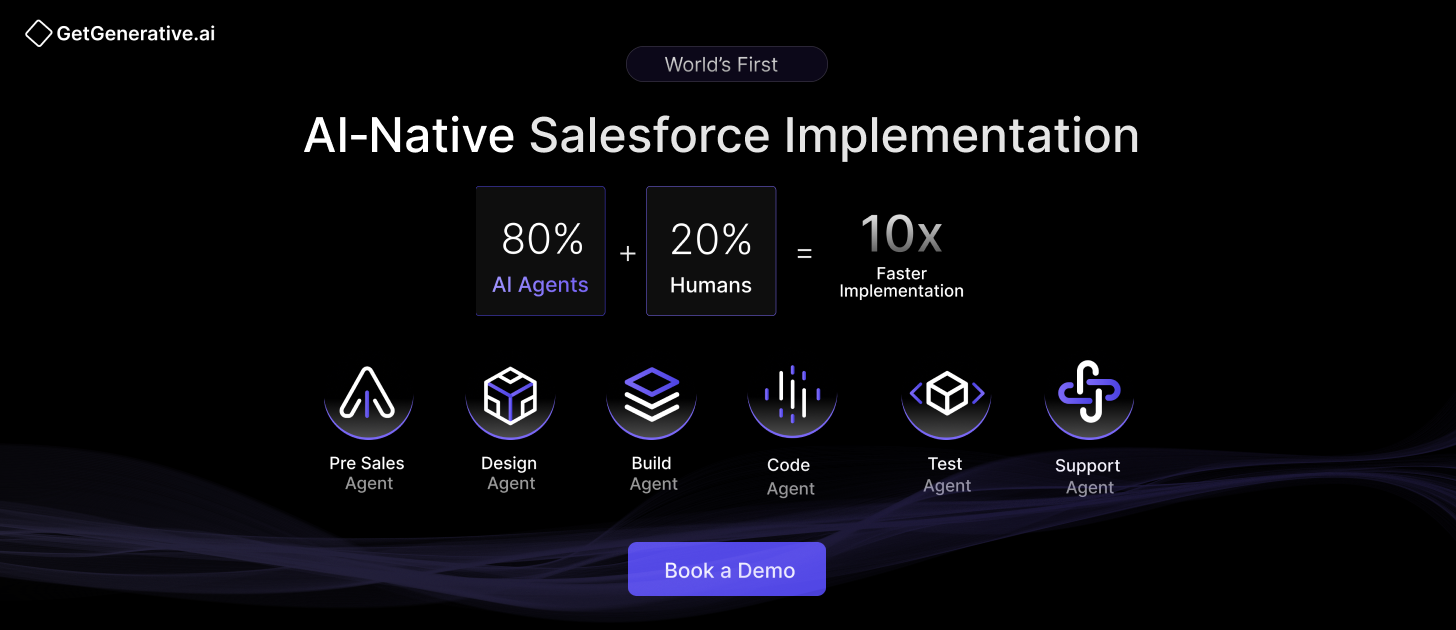

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services