Salesforce Financial Services Cloud vs Sales Cloud: Key Differences

The global finance cloud market reached $32.8 billion in 2024 and is projected to grow at a 22.7% compound annual growth rate through 2034, according to Global Market Insights. This explosive growth reflects a critical shift: financial institutions are embracing specialized cloud solutions to future-proof their business models and drive sustainable value.

At the center of this shift lies a key decision for technology and business leaders: should they adopt Salesforce Sales Cloud, a versatile and widely adopted CRM platform, or Financial Services Cloud (FSC), a vertical-specific solution built for the unique needs of banks, credit unions, wealth managers, and insurers?

Let’s find out in this blog!

What is Salesforce Sales Cloud?

Sales Cloud is Salesforce’s original and most widely adopted platform. Designed as a general-purpose CRM, it supports the sales lifecycle across industries—from lead acquisition to opportunity management, forecasting, and deal closure. It’s used by over 150,000 companies globally, including more than 80 percent of the Fortune 500.

The platform delivers a comprehensive set of tools for sales teams. It includes advanced lead scoring powered by Salesforce’s Einstein AI, intuitive deal management interfaces with Kanban-style visualization, real-time pipeline and revenue forecasting, and built-in tools for quoting and proposal generation. Sales reps benefit from streamlined data entry, automated workflows, and predictive analytics that suggest next-best actions based on historical customer behavior.

One of Sales Cloud’s major strengths is its flexibility. Companies can start small and scale over time, choosing between different editions with increasing levels of sophistication. Sales Cloud can be configured for small teams needing basic lead tracking, or for large enterprises requiring complex territory management, custom reporting, and AI-driven decision support.

Mobile accessibility ensures that field reps can access customer information, update opportunities, and view dashboards on the go. Built-in integrations with Gmail, Outlook, Slack, and other productivity tools enhance efficiency, while workflow automation reduces administrative burdens by up to 38 percent, according to implementation case studies.

For organizations seeking a horizontal CRM solution that adapts to a variety of sales environments, Sales Cloud offers both the stability of a mature platform and the innovation of continuous AI-driven upgrades.

What is Salesforce Financial Services Cloud?

While Sales Cloud excels in general-purpose CRM use cases, Financial Services Cloud was created to serve the unique challenges of the financial sector. FSC is more than just a re-skinned version of Sales Cloud—it’s a reimagined CRM platform with a pre-configured data model, industry-specific workflows, and regulatory compliance features built in.

FSC is used by banks, credit unions, insurance providers, wealth advisory firms, and asset managers to manage complex client relationships, meet strict regulatory standards, and deliver personalized financial experiences. It supports the full customer lifecycle—from prospecting to onboarding, servicing, and retention—with built-in support for Know Your Customer (KYC), Anti-Money Laundering (AML), and regulatory reporting.

One of FSC’s most powerful features is Household Management, which allows institutions to track and manage multi-generational relationships, legal ownership structures, business affiliations, and financial dependencies across individuals and entities. This is especially critical in private banking, family offices, and insurance, where understanding the full financial picture of a client involves more than a single account.

FSC’s Financial Account object enables firms to manage a wide range of products, including checking accounts, investment portfolios, insurance policies, mortgages, and loan instruments. Advisors can view performance metrics, balances, and milestones associated with each financial product and link them to personalized financial goals such as retirement planning, college savings, or home ownership.

The Actionable Relationship Center (ARC) further enhances visibility by offering a visual, graph-based interface to navigate relationships between clients, financial accounts, institutions, and intermediaries. This tool helps identify referral paths, detect hidden cross-sell opportunities, and personalize outreach strategies based on household dynamics.

To ensure consistency and compliance, FSC includes Action Plans, which are predefined workflow templates that guide advisors through complex tasks such as onboarding, loan origination, and claims processing. These workflows standardize the experience across teams and ensure critical compliance steps—such as document verification, approvals, and disclosures—are never missed.

From data encryption and audit trails to role-based access controls and advanced risk monitoring through Salesforce Shield, FSC is architected with security and compliance in mind. It also integrates seamlessly with Salesforce’s Data Cloud, MuleSoft, and third-party banking, wealth, and insurance systems.

Key Differences in Architecture and Capabilities

The core distinction between Sales Cloud and FSC lies in their data model and industry focus. Sales Cloud uses general CRM objects such as Accounts, Contacts, Leads, and Opportunities, which are well-suited for simple or generic sales cycles. However, adapting this model for financial services requires extensive customization, often leading to additional development time, technical debt, and maintenance overhead.

In contrast, FSC includes native support for financial services constructs like Financial Accounts, Households, Policies, Referrals, and Financial Goals. These industry objects come with associated workflows, permissions, and reporting structures tailored for advisors, bankers, and insurance agents.

For example, where Sales Cloud might treat a high-net-worth individual as a single Account, FSC would represent that client within the context of their full household, capturing spouses, children, trustees, and business interests. It would also allow advisors to track referrals from attorneys, wealth planners, or existing clients—enabling a more nuanced, relationship-driven growth strategy.

Instead of a pipeline of Opportunities with stage-based tracking, FSC allows organizations to create and manage client financial goals, aligning multiple financial products with each goal and tracking progress over time. This goal-centric model mirrors how real financial advisory relationships work and supports deeper personalization.

Finally, FSC includes regulatory support that’s absent in Sales Cloud by default. Built-in KYC and AML workflows, integration with identity verification tools, and audit logs provide critical infrastructure for compliance teams. These features make FSC more than just a CRM—it’s a compliance-ready client management platform purpose-built for finance.

Also Read – Salesforce Financial Services Cloud for Mortgage Lending

ROI, Cost-Benefit, and Total Ownership Analysis

When comparing Salesforce Sales Cloud and Financial Services Cloud, it’s essential to evaluate not just the licensing cost but also the measurable business impact, long-term operational savings, and strategic growth potential each platform enables.

Financial Services Cloud consistently delivers stronger quantified returns for financial institutions with complex compliance needs and multi-layered client relationships. In a Nucleus Research study, Trilogy Financial achieved a 147% ROI within the first year of FSC deployment, resulting in more than $972,000 in annual benefits and a one-year payback period. Other institutions have reported similar outcomes, including 27% improvements in customer satisfaction, 24% gains in employee productivity, 26% reductions in operational costs, and 28% growth in sales performance. Credit unions using FSC have documented a 45% increase in lead generation and significant reductions in manual processing thanks to AI-driven lead prioritization.

While FSC’s starting cost is significantly higher than Sales Cloud, these additional expenses are offset by avoided customization costs, faster time to value, and revenue enhancements from improved cross-selling and client retention. Many mid-sized banks that would otherwise spend hundreds of thousands of dollars customizing Sales Cloud for regulatory and household management features have saved between $200,000 and $500,000 by adopting FSC’s pre-built industry functionality.

Over a three-year period, the difference in total cost of ownership between the two platforms is often outweighed by FSC’s productivity and revenue gains. The additional investment required for FSC can be recovered in less than a year in many cases, with a three-year net benefit exceeding one million dollars.

Industry-Specific Applications

The true strength of Financial Services Cloud lies in its ability to support diverse financial services verticals without extensive modifications.

Banking and Credit Unions use FSC to unify client information across accounts, loans, and products, providing tellers and relationship managers with a complete view of each customer. Compliance workflows for KYC and AML are built in, reducing regulatory risk. Lending operations are streamlined through automated document collection, approvals, and task routing, while household views help identify relationship-based pricing opportunities and cross-sell potential.

Wealth Management Firms leverage FSC’s goal-based planning and portfolio integration to deliver highly personalized advisory services. The Actionable Relationship Center maps complex family and trust structures, enabling multi-generational wealth planning and coordinated investment strategies. Advisors can consolidate portfolios from multiple custodians, track progress toward financial goals, and manage referrals from high-net-worth networks.

Insurance Providers benefit from FSC’s policy lifecycle management, which covers everything from policy application to claims settlement. Territory management, agent productivity dashboards, and commission tracking help maximize sales performance, while integrated fraud detection workflows improve risk management. The household view also enables insurers to analyze coverage gaps across family members and propose relevant policy upgrades.

Asset Management Firms use FSC for institutional client management, capturing complex organizational hierarchies, tracking investment committee decisions, and automating regulatory reporting. These features are particularly valuable for compliance with investment advisor regulations and for managing multi-entity account structures.

Integration Capabilities

Financial Services Cloud integrates deeply into the Salesforce ecosystem and beyond. Core banking systems such as FIS, Jack Henry, and Temenos can be connected to FSC, allowing real-time balance updates, transaction history, and account status to flow directly into advisor dashboards.

Wealth and investment advisory firms can integrate FSC with portfolio management platforms and financial planning software to ensure goal tracking and performance reporting are always in sync. Salesforce MuleSoft further extends these capabilities, enabling secure API-based integrations with legacy financial systems.

From a compliance standpoint, FSC connects to RegTech solutions for automated identity verification, sanctions screening, and suspicious activity reporting. Built-in workflows trigger these processes at key client lifecycle stages, ensuring no compliance step is missed.

Also Read – Salesforce Financial Services Cloud For Insurance Service

Implementation Strategy and Best Practices

Deploying FSC requires a more specialized approach than Sales Cloud due to its advanced features and industry-specific data model. The most successful implementations begin with a thorough readiness assessment that examines data quality, integration complexity, user adoption readiness, and alignment with regulatory frameworks.

A phased rollout approach minimizes disruption while delivering early wins. The initial phase typically focuses on foundational CRM setup, migrating essential data, and connecting basic productivity tools. The next phase layers on FSC’s financial account management, household mapping, and core banking integrations. The final phase introduces advanced features such as Action Plans, ARC, and third-party system integrations.

Change management is critical. Financial institutions adopting FSC should secure strong executive sponsorship, design role-specific training programs, introduce new features gradually, and establish continuous feedback loops to fine-tune workflows.

Final Recommendations

For most banks, credit unions, insurance companies, wealth managers, and asset management firms, Financial Services Cloud represents a superior long-term investment. It delivers industry-specific capabilities, regulatory compliance, advanced analytics, and relationship management features that simply cannot be matched by customizing Sales Cloud without significant cost and effort.

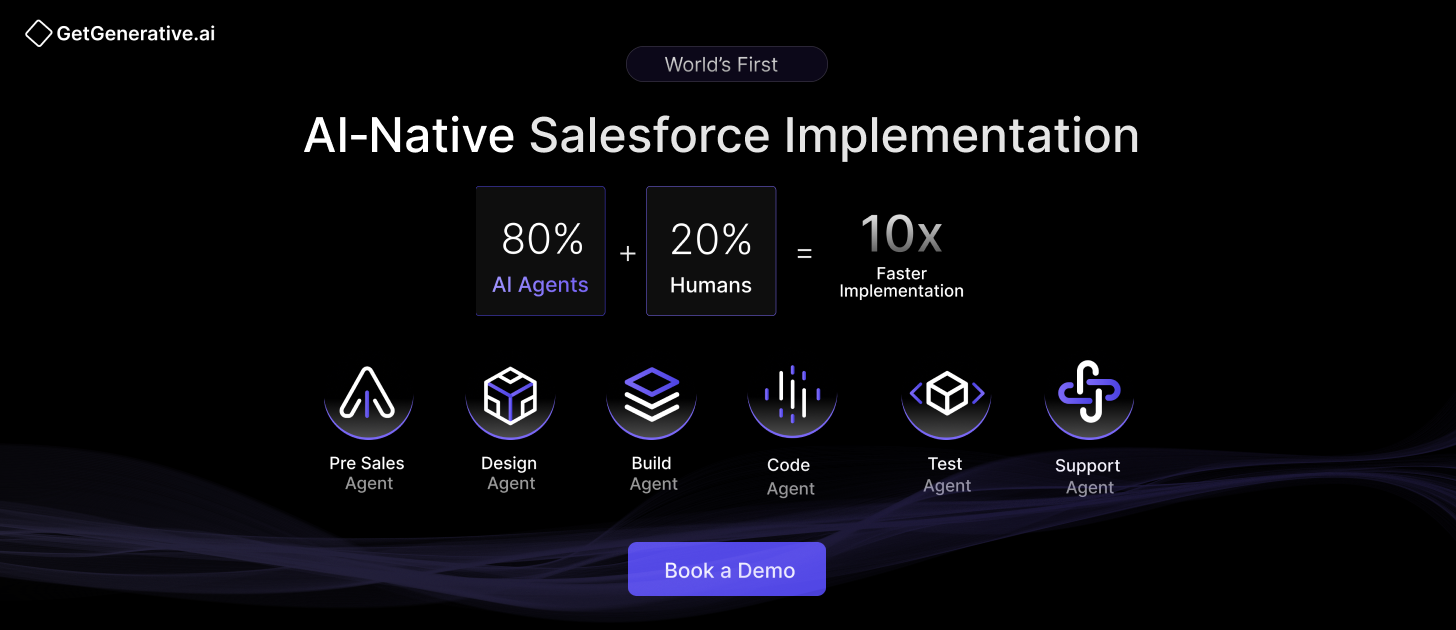

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services