Salesforce Financial Services Cloud vs Service Cloud: Key Differences

The financial services industry is at a critical inflection point. With the global CRM market projected to reach $262.74 billion by 2032 and institutions under mounting pressure to deliver personalized, omnichannel customer experiences, selecting the right Salesforce solution is now a boardroom-level decision.

The choice between Salesforce Financial Services Cloud (FSC) and Salesforce Service Cloud is about defining how the organization will manage customer relationships, drive operational efficiency, and maintain a competitive edge in a rapidly evolving market.

This blog breaks down all the differences you need to know to choose the right platform for your business needs and long-term transformation. Let’s get started!

Understanding the Core Architecture

Salesforce Service Cloud

Service Cloud is Salesforce’s flagship customer service platform, powering support operations for 150,000+ companies worldwide . Built on the core Salesforce CRM architecture, it offers:

- Case-driven workflows for managing inquiries, with intelligent routing based on skill sets, availability, and complexity.

- Omni-Channel Routing Engine that distributes cases to the right agents automatically.

- Knowledge Management repositories with searchable resolutions and best practices.

- Einstein AI for predictive case routing, automated responses, and analytics.

The Lightning Console serves as a unified agent workspace, consolidating customer history, active cases, and resolution tools into a single interface—critical for organizations handling high-volume, multi-channel interactions.

Pricing: Starts at $25/user/month for essentials and scales to $330/user/month for unlimited capabilities, with a tiered model that supports both SMBs and global enterprises.

Salesforce Financial Services Cloud

Financial Services Cloud builds on Service Cloud’s capabilities but re-architects them for banking, insurance, and wealth management. Its Person Account model is designed to manage complex household and client relationships, mapping family connections, financial products, and multi-generational wealth strategies.

Key differentiators include:

- Native Financial Data Objects: Built-in records for investment accounts, insurance policies, loans, and deposits—ready out-of-the-box without heavy customization.

- Financial Goals Framework: Aligns products and services to client objectives for coherent financial planning.

- Actionable Relationship Center: Gives advisors a visual map of households, referrals, and influence networks .

- Compliance Workflows: Integrated KYC, AML, and FINRA processes for automated onboarding, transaction monitoring, and reporting.

The result is a platform that understands the data relationships and compliance realities unique to financial services—capabilities that Service Cloud would require extensive customization to replicate.

Strategic Capabilities and Business Impact

Service Cloud

Service Cloud excels in multi-industry, multi-channel service delivery. Key capabilities include:

- Omni-Channel Engagement: Seamlessly manage interactions via email, phone, chat, social, and self-service portals.

- Einstein AI Bots: Automate routine inquiries, freeing agents for high-value tasks.

- Service Analytics: Identify case trends, agent performance patterns, and customer satisfaction drivers.

- Field Service Management: Coordinate on-site visits, technician scheduling, and mobile service for distributed teams.

Financial Services Cloud

FSC delivers quantifiable industry-specific ROI:

- 147% ROI in year one, fueled by advisor productivity, deeper client engagement, and higher cross-sell success.

- Wealth Management Excellence: Goal-based planning, integrated with platforms like BlackRock Aladdin and Morningstar for real-time portfolio insights.

- Banking Integration: Consolidates customer data from core banking, credit, mortgage, and investment systems.

- Insurance Optimization: Life event tracking triggers timely product offers and claim follow-ups.

- Compliance Automation: Reduces regulatory risk while cutting operational overhead with built-in KYC/AML workflows.

Also Read – Salesforce Financial Services Cloud vs Sales Cloud: Key Differences

Decision Framework for Platform Selection

Choosing between FSC and Service Cloud is as much a strategic business decision as it is a technology choice.

1. Organizational Readiness Assessment

Before shortlisting a platform, assess your technology infrastructure, data quality, and change management capacity:

- Technology Infrastructure: Evaluate your core systems—banking platforms, loan origination systems, insurance claim processors, and investment management tools. API-enabled, cloud-friendly architectures integrate more smoothly with FSC, while legacy mainframes may demand costly middleware .

- Data Quality: FSC’s household mapping relies on clean, consistent relationship data. If data governance is weak, initial implementation may require significant cleansing .

- User Adoption: Service Cloud is easier for generalist customer service teams, while FSC requires users with financial services domain expertise.

2. Cost-Benefit Analysis

Total Cost of Ownership (TCO) must go beyond licensing:

Cost Component | Service Cloud | Financial Services Cloud |

Licensing | Lower entry cost ($25–$330/user/month) | Higher entry cost due to industry-specific features |

Implementation | $10K+ for basic setup | $200K+ for complex rollouts, but less customization |

Customization | Often required for industry fit | Minimal—financial features are native |

Compliance Automation | Requires add-ons/customization | Built-in KYC/AML/FINRA workflows |

FSC’s higher upfront cost is often offset by reduced customization, faster compliance, and quicker time-to-value in financial services contexts.

3. Industry-Specific Considerations

- Banks: Regional and national banks with complex relationship networks benefit most from FSC’s Person Account model and cross-sell capabilities.

- Wealth Management: FSC’s goal-based planning and portfolio integration with platforms like Morningstar are critical differentiators.

- Insurance Providers: FSC’s life-event tracking supports proactive policy upselling.

- Credit Unions: May opt for Service Cloud initially due to budget, but should model the long-term cost of custom compliance features.

Implementation Strategy and Best Practices

1. Phased Deployment

Rolling out Salesforce in stages reduces risk:

- Phase 1: Deploy core service or relationship management features.

- Service Cloud: Case management + knowledge base

- FSC: Client onboarding + advisor productivity tools

- Service Cloud: Case management + knowledge base

- Phase 2: Add AI-powered insights, workflow automation, or industry-specific modules.

- Phase 3: Complete integrations, advanced analytics, and reporting.

2. Integration and Data Management

- System Integration: Connect Salesforce to banking cores, policy admin systems, trading platforms, and customer portals.

- Master Data Management: For FSC, keeping household relationships and financial products accurate is non-negotiable.

- Security & Compliance: Ensure encryption, role-based access, and audit trails—especially for financial institutions under AML/KYC/FINRA regulations.

3. Change Management and Adoption

- Training: FSC requires financial product knowledge plus Salesforce skills; Service Cloud training focuses on case workflows and customer engagement tools.

- Executive Sponsorship: Projects succeed faster when senior leaders actively champion adoption.

- Performance Measurement: Track KPIs like case resolution times, cross-sell rates, and compliance audit readiness.

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Future-Proofing Your Investment

1. AI and Automation

Both platforms benefit from Einstein AI, but FSC adds industry-specific intelligence:

- Predictive relationship scoring for wealth management.

- Life-event–triggered outreach for insurance.

- Agentforce AI agents (introduced in 2025) for automated task execution.

2. Regulatory Readiness

With compliance frameworks evolving, FSC’s native regulatory workflows can save months of rework:

- Automated KYC/AML processes.

- Pre-configured FINRA reporting templates.

- Audit-ready transaction histories.

3. Open Banking and Fintech Integration

FSC’s prebuilt APIs support partnerships with fintechs, open banking ecosystems, and embedded finance models—a strategic necessity as customer expectations shift towards seamless, cross-platform experiences.

Conclusion

The Service Cloud vs Financial Services Cloud decision boils down to specialization vs flexibility. In either case, success depends on careful planning, leadership commitment, and continuous optimization—turning a CRM purchase into a long-term competitive advantage.

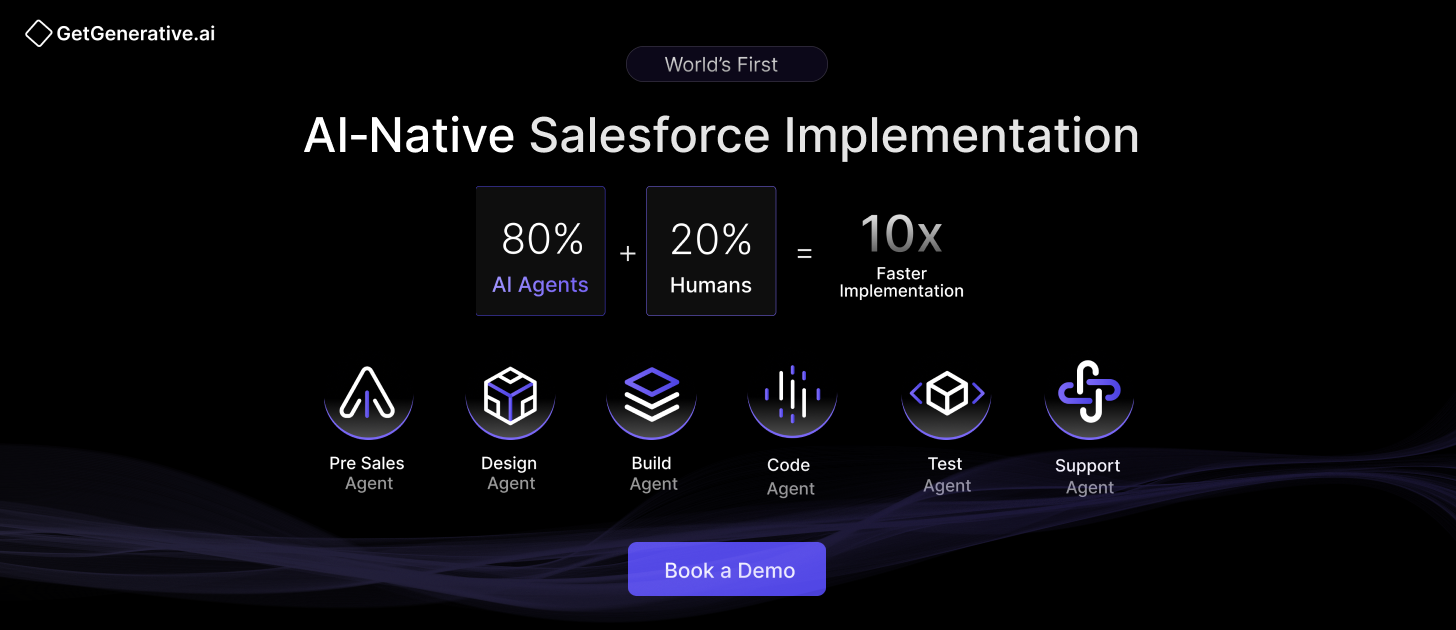

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services