What Is a Household in Salesforce Financial Services Cloud?

In an era where Salesforce implementations have driven 147% ROI and close to $1 million in annual benefits for leading firms, the concept of a household in Salesforce Financial Services Cloud (FSC) has emerged as a critical differentiator for senior professionals aiming to strengthen client engagement, compliance, and sustainable growth.

The household feature in FSC is not just a convenient data grouping tool. It is a sophisticated relationship management system that enables organizations to visualize, analyze, and serve entire family units and their extended financial ecosystems.

Understanding the Household Foundation in FSC

Defining the Household Concept

In Salesforce Financial Services Cloud, a household is defined as a collection of individuals and related entities whose relationships and shared attributes influence how financial institutions serve them. Unlike traditional CRM systems that treat each customer as an isolated record, FSC households capture the full spectrum of relationships—from spouses and dependents to business entities, trusts, and professional advisors.

A household is built on a specialized account record type, forming the technical backbone of FSC’s data architecture. This allows for both simple and complex relationship structures. For example, a high-net-worth client may belong to their immediate family household while also appearing as a beneficiary in their parents’ estate planning household.

The Technical Architecture Behind Households

At the core of FSC’s household management lies the Party Relationship Group object. This architecture integrates several related components:

- Business Accounts – represent the household entity itself.

- Person Accounts – capture individual family members.

- Account Contact Relationships – link individuals to household accounts.

- Contact Contact Relationships – map interpersonal connections.

- Account Account Relationships – define connections between business entities, trusts, and households.

This multi-layered data model ensures that advisors can navigate seamlessly from an individual client record to the entire household’s financial landscape, improving clarity, efficiency, and decision-making.

Strategic Implementation and Business Value

Driving ROI Through Household Management

Real-world examples highlight the measurable business value of FSC households. Trilogy Financial achieved a 147% ROI in just one year, unlocking nearly $972,000 in annual benefits by eliminating data silos and equipping advisors with a consolidated view of client relationships.

According to a Forrester Total Economic Impact study, FSC implementations have delivered:

- $81.3 million in total benefits over three years

- 10% revenue growth from cross-selling and client retention

- Significant improvements in advisor efficiency and compliance visibility

For senior executives, these results provide strong evidence that robust household management capabilities directly translate into financial performance.

Operational Efficiency Gains

Beyond revenue, FSC households dramatically improve efficiency. Institutions report:

- 25% faster call handling

- 50% quicker application processing

- 60% higher campaign efficiency through household-based targeting

These improvements reduce manual effort and empower advisors to dedicate more time to high-value relationship building, succession planning, and multigenerational engagement.

Also Read – The Architecture of Salesforce Financial Services Cloud

Advanced Household Configuration and Customization

Rollup Fields and Data Aggregation

One of FSC’s most powerful features is its automatic rollup functionality, which aggregates financial data across household members. Advisors can instantly view consolidated figures such as:

- Total household assets under management (AUM)

- Combined liability exposure

- Household-wide insurance coverage

- Aggregate investment performance

Configuring rollups requires defining Record Rollup Definitions that specify the rules for aggregation (e.g., summing balances across only active accounts). Done right, this gives advisors a complete financial picture at the household level.

Relationship Mapping and Visualization

The Actionable Relationship Center (ARC) is FSC’s visualization engine, turning complex data into intuitive maps that display:

- Family decision-making hierarchies

- Extended network referral opportunities

- Concentrations of financial risk

- Succession planning pathways

ARC empowers advisors to quickly identify opportunities and risks that would otherwise remain buried in spreadsheets or siloed systems.

Customizing Household Roles and Relationships

FSC also supports flexible customization of household roles. Standard roles like spouse, dependent, trustee, and beneficiary can be extended with custom reciprocal roles tailored to an institution’s unique client base.

Best practices include:

- Governance for role creation to avoid redundant or conflicting roles.

- Validation rules that maintain consistency across records.

- Specialized roles for unique segments (e.g., international family offices or blended households).

By enforcing strict data quality measures, organizations ensure that household insights remain reliable and actionable.

Security, Compliance, and Data Governance

Regulatory Considerations

Household management in FSC must align with strict financial services regulations across privacy, security, and data handling. Salesforce provides built-in compliance features that help institutions adhere to frameworks like GLBA, SEC, and state-specific regulations. These include:

- Comprehensive audit trails for all household modifications

- Data retention enforcement based on internal policies

- Consent management to govern communications with household members

- Granular access controls tied to roles and relationships

By embedding governance directly into the household model, institutions can balance the need for relationship visibility with stringent privacy protections.

Security Model Implications

The FSC security model allows organizations to apply household-specific sharing rules. For example, a senior advisor may be granted full access to a primary client’s data but limited (read-only) access to their spouse’s or dependent’s records, depending on documented consent.

Financial institutions should carefully design permission sets and sharing logic to strike the right balance between accessibility for advisors and compliance with regulatory constraints.

Implementation Best Practices and Challenges

Phased Implementation Strategy

The most successful household implementations follow a phased roadmap to build competency gradually while minimizing disruption. Recommended stages include:

- Data model design aligned with current business processes

- Pilot deployments with experienced advisory teams

- Rollup field configuration for key metrics like AUM and liabilities

- Integration with banking/wealth management systems for real-time synchronization

- User training programs focused on relationship-driven workflows

This structured rollout ensures both technical stability and user adoption.

Common Pitfalls to Avoid

Research shows that FSC household implementations often falter due to insufficient planning and stakeholder alignment. Frequent challenges include:

- Vague or unclear business objectives

- Poor data quality inherited from legacy CRMs

- Low adoption rates due to limited training

- Integration complexity with older systems

- Resistance to change from advisors accustomed to siloed processes

Mitigation strategies include early definition of success metrics, comprehensive data cleansing, and ongoing change management.

Data Migration Considerations

Migrating household data from legacy CRMs is often the most complex task. Best practices include:

- Conducting comprehensive audits to resolve relationship inconsistencies

- Establishing naming conventions for household entities

- Implementing validation rules for consistent mappings

- Using incremental migration to reduce business disruption

Institutions that invest in data preparation upfront are better positioned to unlock the full value of FSC households.

Also Read – Top Use Cases of Salesforce Financial Services Cloud in 2025

Integration with the Broader Salesforce Ecosystem

Service Cloud Integration

FSC households integrate seamlessly with Service Cloud, providing support agents with a 360-degree view of household interactions. This improves first-call resolution rates and client satisfaction, particularly for high-net-worth households that demand white-glove service.

Agents can see:

- All household members’ recent cases and interactions

- Shared service preferences

- Pending service requests across the family

Marketing Cloud Synergy

With Marketing Cloud, institutions can run household-based campaigns that align with life events and relationship dynamics. Use cases include:

- Targeting multiple generations within affluent families

- Coordinating messaging across related members

- Running referral-based campaigns leveraging extended networks

- Personalizing outreach based on shared financial goals

This approach boosts marketing ROI while staying aligned with compliance on household communications.

Data Cloud Analytics

Integration with Salesforce Data Cloud enables advanced analytics, helping institutions uncover deeper insights such as:

- Cross-sell and upsell opportunities across households

- Risk concentrations across related entities

- Behavioral signals indicating life events (marriage, retirement, inheritance)

- Portfolio optimization opportunities

These insights equip advisors to shift from reactive to proactive client engagement.

Future Trends and Strategic Considerations

AI and Machine Learning

The fusion of AI/ML with household data is reshaping financial services. Applications include:

- Predictive analytics to anticipate life events (e.g., children entering college)

- AI-driven relationship mapping from emails and interactions

- Automated cross-sell recommendations tailored to household needs

- Risk scoring models incorporating interdependencies across family units

Firms that invest early in AI-driven household insights will gain a long-term competitive edge.

Evolving Regulatory Landscape

As privacy laws and compliance standards evolve, institutions must maintain flexibility to adjust household configurations. Key areas include:

- Enhanced consent frameworks for family data sharing

- Data portability rights as mandated by new consumer protection laws

- Cross-border compliance for multinational households

- Expanded audit trail requirements for regulators

Market Expansion Opportunities

With the finance cloud market projected to hit $217.30 billion by 2034, household mastery will be a market share differentiator. Early adopters of FSC’s household model will be positioned to lead as competition intensifies in wealth management, retail banking, and insurance.

Conclusion

The household model in Salesforce Financial Services Cloud represents a paradigm shift from siloed client management to a relationship-centric approach to engagement. With ROI benchmarks showing 147% improvements and annual benefits approaching $1 million, FSC households are crucial for institutions seeking to thrive in a competitive market.

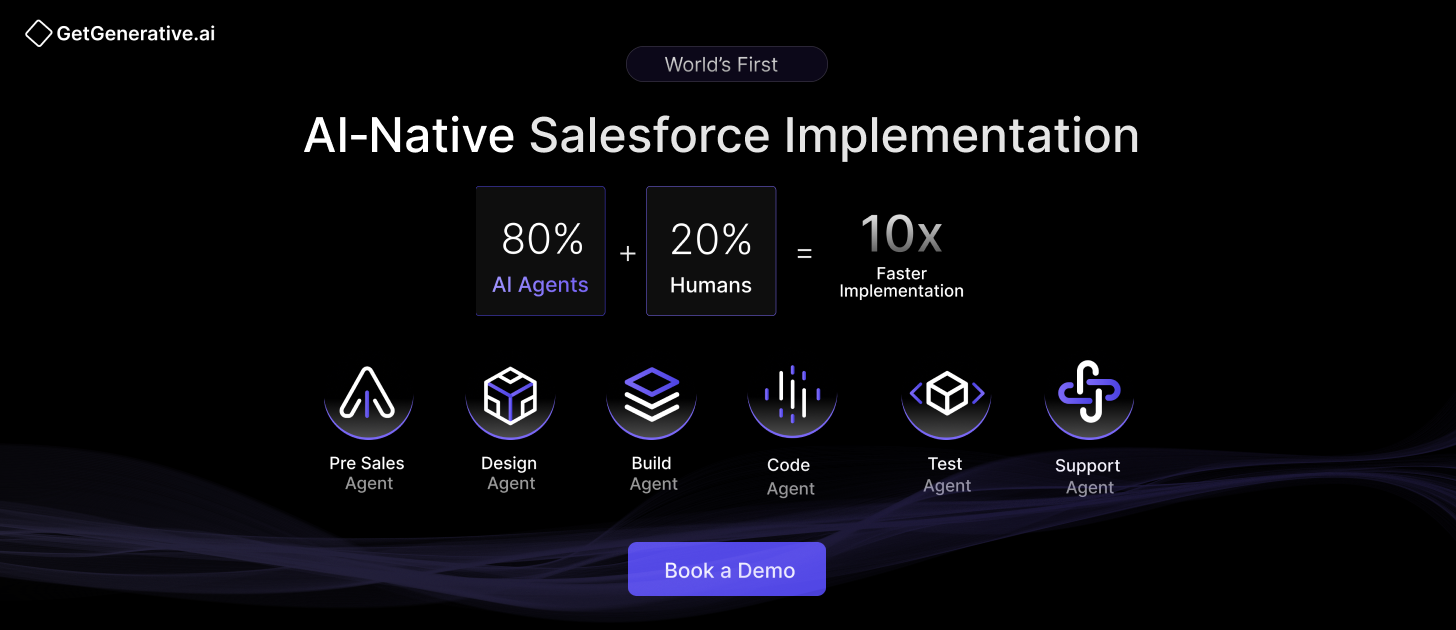

At GetGenerative.ai, we’ve reimagined Salesforce implementation—built from the ground up with AI at the core. This isn’t legacy delivery with AI added on. It’s a faster, smarter, AI-native approach powered by our proprietary platform.

👉 Explore our Salesforce AI consulting services