Salesforce Implementation in Banking: A Complete Guide for 2025

The global banking industry is undergoing seismic shifts in 2025. Amid tightening regulations, emerging fintech rivals, and soaring customer expectations, banks can no longer rely on legacy systems and impersonal service models.

Customer expectations are soaring, yet fewer than half are satisfied with current banking services, demanding faster, more seamless digital experiences.

In this transformation, Salesforce stands out as a mission-critical platform for reimagining how banks attract, engage, and retain customers.

This guide is for banking professionals and decision-makers looking to modernize their institutions with Salesforce. This blog will help you plan and execute a high-impact Salesforce deployment that meets the modern demands of customers and regulators.

Why Banks Must Act Now

The Customer Experience Divide

Today’s banking customers expect digital-first, hyper-personalized services. According to Salesforce’s Connected Financial Services Report, over 46% of consumers and 55% of high earners say they would stay with a bank that provides an excellent experience, even if it raises its fees. However, fewer than 41% of wealth clients are fully satisfied with their institution’s responsiveness.

Banks that fail to meet these expectations risk customer churn and lost revenue. The pressure is clear: service speed, personalization, and convenience are now as important as rates and fees. This is where Salesforce delivers immediate value.

Why Salesforce?

Salesforce offers more than a CRM—it’s a financial engagement platform. Purpose-built solutions like Financial Services Cloud (FSC) are tailored to banking operations, with industry-specific data models, workflows, and AI tools.

Key highlights include:

- A 360° customer view across products, channels, and lifecycle stages.

- Prebuilt workflows for account onboarding, loan approvals, and lead referrals.

- AI-powered insights for personalization, compliance, and risk management.

- Integration with core banking systems via MuleSoft and native APIs.

- Scalability and innovation, with three major Salesforce releases each year.

Banks like Ponce Bank, Mascoma Bank, and City National Bank have already transformed their service models, achieving measurable gains in productivity, customer satisfaction, and regulatory compliance.

Key Benefits of Salesforce Implementation in Banking

1. 360° Customer View & Personalization

Salesforce consolidates customer data from siloed systems into a single, real-time profile. For example:

- Mascoma Bank unified data from 66 systems using FSC and Data Cloud, enabling holistic customer insights.

- Ponce Bank replaced over 54 disconnected tools with Salesforce, streamlining service delivery.

With this 360° view, bankers can anticipate customer needs and offer relevant advice—e.g., promoting a mortgage product when a customer’s financial behavior signals intent.

2. Data-Driven Sales & Cross-Selling

FSC includes “white space” indicators—AI-generated cues highlighting unmet customer needs. This fuels targeted cross-selling:

- Credit card offers for checking-only clients.

- Wealth services for high-net-worth segments.

- Business accounts for self-employed customers.

Banks using Salesforce report higher wallet share and revenue per customer.

3. Automation & Operational Efficiency

Salesforce automates high-friction banking workflows:

- City National Bank cut loan underwriting time by 30% and increased loan approvals by 25% through automated credit analysis.

- Mascoma Bank reduced loan processing time by 13 days, saving 45 minutes per loan with digital onboarding.

Automation frees teams from repetitive tasks, accelerates processing, and reduces errors.

4. Superior Customer Service

With Service Cloud, banks route and resolve issues across all channels:

- Mascoma Bank saw a 98% drop in hold times by using unified case management.

- Agents access full customer histories in real time, improving first-call resolution.

This translates into greater loyalty, especially as 50%+ of customers would stick with a bank for service quality alone.

5. AI-Driven Insights & Risk Monitoring

Tools like Einstein AI and Tableau CRM help banks detect:

- Early signs of churn (e.g., declining activity).

- Credit or compliance risks.

- High-value engagement opportunities.

Executives gain dashboards that track KPIs, forecast behavior, and optimize decision-making across functions.

6. Regulatory Compliance & Reporting

Compliance is costly: institutions spend 1,000–4,999 hours/year on regulatory tasks. Salesforce simplifies this with:

- Automated logging of consents and customer interactions.

- Built-in audit trails and privacy compliance (e.g., MiFID II, GDPR, SOC 2).

- One-click reporting instead of manual data reconciliation.

Salesforce Shield, Field Audit Trail, and Encryption ensure data security and policy adherence.

7. Scalability and Continuous Innovation

Salesforce grows with your bank:

- Add users, branches, and products without system overhauls.

- Access AppExchange for 3,400+ plug-and-play integrations.

- Stay updated with three platform upgrades per year—each packed with new tools, including Einstein GPT for generative AI capabilities.

Also Read – Key Features of Salesforce Financial Services Cloud

Strategic Planning for Salesforce in Banking

Align with Business Goals

Salesforce success begins with a clear “why.” Common goals include:

- Improving customer acquisition and onboarding speed.

- Boosting cross-sell ratios in retail banking.

- Reducing service resolution times.

- Enhancing compliance oversight.

Bring together IT, business, and compliance leaders to prioritize features that match these goals.

Define Use Cases and Data Needs

Map essential banking processes to Salesforce functionality:

Use Case | Salesforce Feature |

Customer Onboarding | FSC workflows, Service Cloud, KYC fields |

Lead and Referral Management | Sales Cloud, Opportunity Management |

Loan Origination | Custom flows, document automation |

Support and Case Handling | Omni-Channel Routing, Case Queues |

Campaigns and Offers | Marketing Cloud Journeys, Segmentation |

Also plan your data architecture. This includes:

- Which systems (core banking, LOS, fraud, etc.) feed Salesforce?

- Which fields need encryption (e.g., SSNs)?

- How will duplicates and outdated records be handled?

Choosing the Right Salesforce Products and Integration Tools

Salesforce’s vast ecosystem can be overwhelming, but banks can streamline implementation by focusing on the following components:

Core Products for Banking

Salesforce Product | Role in Banking CRM |

Financial Services Cloud | Industry-specific data model with objects for accounts, goals, referrals, etc. |

Sales Cloud | Pipeline and opportunity tracking for loans, deposits, and relationship sales |

Service Cloud | Omni-channel case management, support automation, and agent productivity |

Marketing Cloud | Personalized campaigns, onboarding journeys, and lifecycle messaging |

CRM Analytics (Tableau) | Dashboards for leadership, risk tracking, and performance monitoring |

MuleSoft | Integration with core systems, LOS, digital banking platforms via APIs |

Data Cloud | Real-time customer data unification and AI-powered segmentation |

Experience Cloud | Portals for customers, partners, and agents |

Examples:

- Mascoma Bank paired FSC with Data Cloud to gain a complete view of customers and enable real-time insights.

- Ponce Bank leveraged Marketing Cloud to send automated onboarding journeys to underserved communities.

- Caribbean provider used Salesforce + MuleSoft to replace a failing custom credit reporting tool with real-time, compliant automation.

Integration & Data Migration

Integration is where many banking projects succeed—or stumble. Here’s a smart approach:

Integration Planning Checklist

- Audit Current Systems: Core banking, LOS, KYC, digital channels.

- Choose Integration Pattern:

- Real-time (API) for transactional sync (e.g., account updates).

- Batch/ETL for periodic data (e.g., balances, transaction logs).

- Event-driven (CDC/Platform Events) for responsive syncing.

- Federation (Salesforce Connect) to expose data without storing it.

- Define Data Ownership and Flow Direction:

- Who owns master data?

- When Salesforce updates data vs. just reads it?

Data Migration Considerations

- Cleanse and deduplicate records (bad CRM data → bad outcomes).

- Map legacy CRM data (e.g., spreadsheets or in-house tools) to Salesforce fields.

- Pilot migrations with user validation to build trust.

Security First:

Encrypt sensitive data, use Shield for field audits, define granular access controls, and align with regulatory data residency rules.

Implementation Roadmap: Budget, Timeline & Phasing

Timeline Guidance (Example for Mid-Sized Bank)

Phase | Scope | Duration |

Phase 1 | Retail CRM, Case Management | 3–6 months |

Phase 2 | Loan Origination, Compliance Workflows | 6–9 months |

Phase 3 | Marketing Automation, Advanced Analytics | 6 months |

Total roadmap = ~18 months with overlapping phases for faster ROI.

Cost Planning

Don’t forget to budget for:

- Salesforce licenses and add-ons

- Consulting partners with banking domain expertise

- Internal team ramp-up

- Ongoing support and enhancement cycles

Related Read – Salesforce Financial Cloud Implementation Guide 2025

Change Management

Change is hard. Adoption is harder. But it’s critical.

Key Adoption Strategies

- Stakeholder Involvement: Get feedback from every team – sales, support, and compliance.

- Role-Based Training: Tailor sessions for loan officers, contact center reps, marketers, etc.

- In-App Guidance: Use Salesforce’s prompts and walkthroughs to reinforce new behavior.

- Show Quick Wins: Share early metrics—“Loan decisions 25% faster,” “Customer hold times down 98%.”

Real-World Case Studies

1. Ponce Bank

- Challenge: 54 disconnected systems, no unified customer view.

- Solution: FSC + MuleSoft + Marketing Cloud.

- Results: Unified 360° view, automated onboarding, increased productivity across all teams.

2. City National Bank

- Challenge: Manual loan processing and slow underwriting.

- Solution: Salesforce for lending workflows and automation.

- Results: Underwriting time ↓ 30%, approval rates ↑ 25%.

3. Mascoma Bank

- Challenge: 66 siloed systems and long service wait times.

- Solution: Salesforce Einstein 1 Platform (FSC + Data Cloud).

- Results: Hold times ↓ 98%, loan processing cycle ↓ from 1 year to 13 days.

4. Caribbean Financial Provider

- Challenge: Manual, error-prone credit reporting.

- Solution: Salesforce with real-time API integration.

- Results: 100% report delivery success, SOC 2 compliance achieved.

Future Trends

1. AI-Powered Automation

- Einstein AI → Next-best-actions, churn prediction, AI-powered financial guidance.

- Einstein GPT → Auto-generate case summaries, marketing emails, knowledge articles.

- AI Agents → Automate underwriting, analyze transaction risk, and recommend offers in real-time.

2. Omnichannel Engagement

- Service Cloud Omni-Channel Routing ensures consistent support across web, app, call center, and branch.

- Experience Cloud portals enable 24/7 self-service.

- Marketing Cloud + WhatsApp, email, SMS = unified communication.

3. Data-Driven Personalization

- Data Cloud merges real-time data from digital banking, core systems, and external sources.

- AI triggers offer recommendations based on behavior (e.g., large deposit → suggest investment plan).

4. Continuous Innovation

- AppExchange: Mortgage calculators, digital ID verification, KYC modules.

- Salesforce Releases: Flow Builder upgrades, analytics enhancements, AI personalization tools.

- Partner Ecosystem: Certified integrations with fintechs and legacy systems.

Conclusion

The time for legacy systems and disconnected data is over. In 2025, banking success hinges on delivering personalized, fast, and compliant customer experiences—and Salesforce provides the ideal platform to do just that.

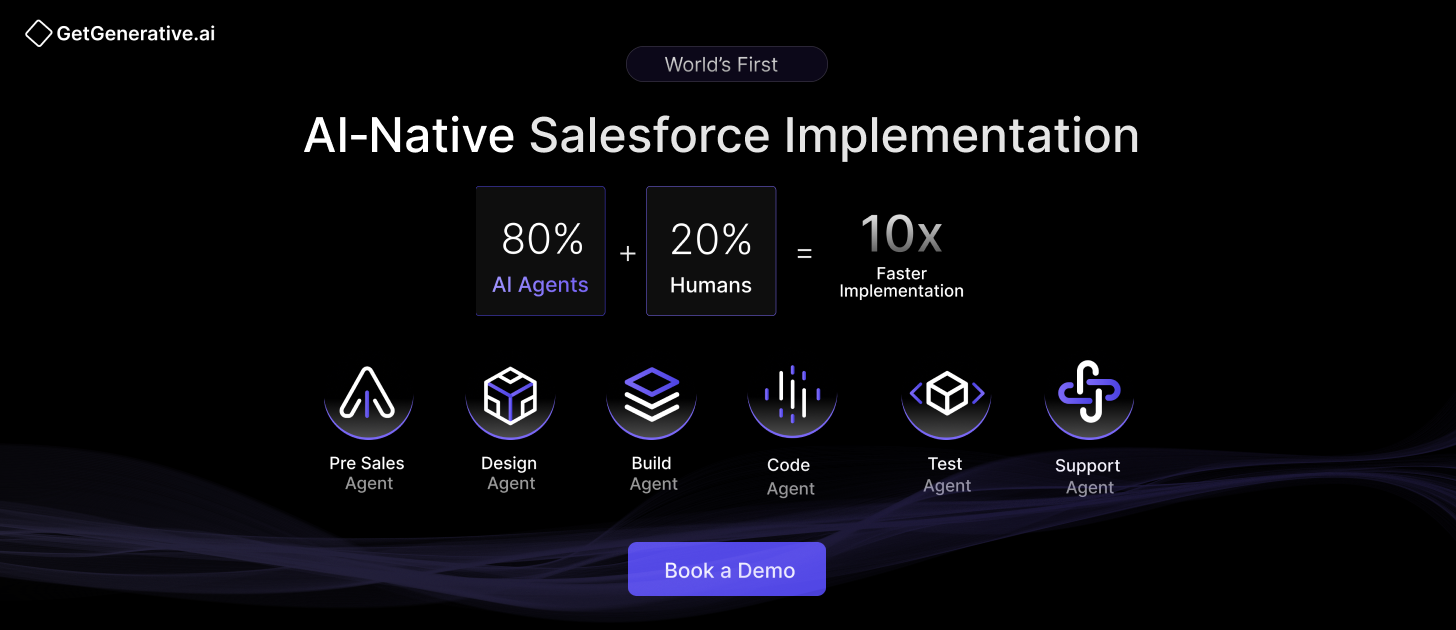

At GetGenerative.ai, our proprietary AI platform powers purpose-built Agents that automate your entire Salesforce implementation, while our top 1% global experts provide oversight, strategy, and quality control.

10x faster. AI-first. Human-reviewed.

👉 Explore our AI Salesforce Consulting Services